The European recovery theme has become increasingly mainstream in recent weeks as continued Euro-area growth out-performance intersects with moderating political risks.

Last week, we opened an outright long EUR/USD position in covered call format to go with a suite of other bullish Europe expressions (long SEK, CHF).

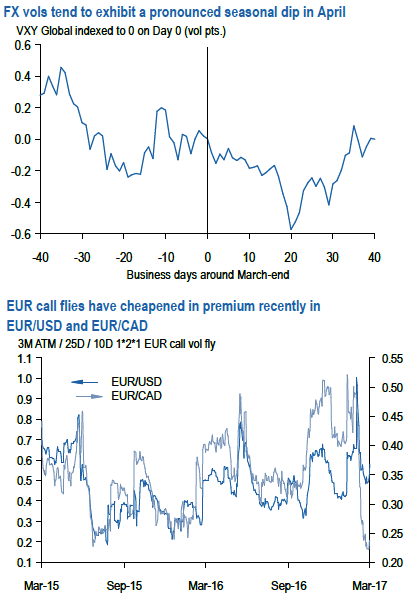

We list below a few other option-based expressions of Euro strength assuming that French elections deliver a market-friendly outcome: EUR call flies: Our spot targets for EURUSD if Le Pen loses are relatively benign – in the range of 2-3 cents from current levels since neither positioning metrics nor deviations from high-frequency fair value models suggest that there is much political risk premium in the currency that requires de-pricing.

In addition, EUR options still pack in a reasonable amount of election risk premium despite their recent softening, which will almost certainly disappear after the passage of the event – a key reason to recommend

As the VXY enters April near 2-yr lows having come off a full vol in March, it is hard to escape the sense that the timetable for the classic pump-in-April-dump-in-May pattern in risk markets is being pulled forward. Investors are well aware of the seasonal decline in FX vols in April (refer above chart) and the potential for pent-up demand for European and EM equities to fuel the next stage of the risk rally, yet are conflicted about value in short-selling options at current levels as the dollar’s cheapness vis-à-vis rates preserves the risk of a sharp snapback, trade/currency policy risks heat up next week onwards and ebbing momentum in commodities raises concerns that the reflation trade may be due a correction.

Our best guess is that risk markets will hold in and vols remain sideways to mildly lower into Easter, but remain wary of the possibility of a stray poll or TV debate to re-inject risk premium into Euro-pairs that has faded considerably in recent weeks.

The paucity of genuine value and lack of trends is not amenable to large risk allocations and leads us to trim a couple of soon-to-expire positions in our paper book (CADJPY – EURJPY gamma spread, EURCNH put spreads). This note remains deliberately focused on Europe which increasingly looks like the one durable macro theme worth allocating to. Sell CADJPY 1Y 25D RR via vanilla puts vs. sell EURJPY 1M ATM straddles, vega-neutral.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025