A quiet day for euro area economic data saw the release this morning of German PPI figures for October, which continued to illustrate disinflationary pressures down the price pipeline. In particular, producer prices fell for the fourth month out of the past six, to leave the annual PPI rate down 0.5ppt to -0.6%Y/Y, the steepest drop for more than three years. Of course, this principally reflected a further fall in energy prices, down 1.2ppts to -3.1%Y/Y, the steepest decline for three years. In contrast, consumer non-durable price inflation rose ½ppt to 2.3%Y/Y, the strongest rate for almost two years. Nevertheless, with prices of intermediate goods still falling and capital goods little changed, the core PPI rate moderated further at the start of Q4, to just 0.3%Y/Y, indicating that underlying price pressures are effectively non-existent.

Euroarea PMI data is scheduled for the next week, the data indicates the economic health and businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

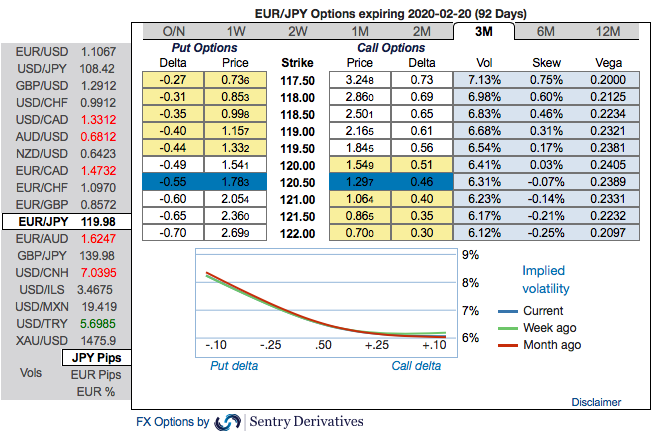

Euro crosses have been weaker today, especially, EURJPY that shows slumps of -0.27% from yesterday. Technically, the pair’s downtrend resumes on the failure swings at channel resistance, RSI shows faded strength but stochastic & MACD still mildly bullish bias. We could foresee the retest of 117 levels again in the weeks to come.

OTC outlook: Please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts expect that the underlying spot FX likely to show further dips so that OTM instruments would expire in-the-money (bids upto 117.50 levels).

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal (RR) set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m negative RRs suggest the overall OTC hedging sentiments for the further bearish risks. Hence, we advocate below hedging strategy contemplating the current OTC indications.

Options Strategy: Contemplating above factors, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips. since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for December month deliveries ahead of Euroarea PMIs. Source: Sentrix, Daiwa & Saxobank

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025