The Bavarian state elections did not have an impact on the euro. Since nobody really expects Bavaria to re-introduce the Bavarian guilder or Hesse to be thrown out of the euro if voters reject the abolishment of capital punishment in two weeks, state elections in Germany are a non-event for the euro.

And that is true even if their outcomes make life more difficult for the grand coalition in Berlin. If, in a worst-case scenario, early elections were held, any new government would certainly consist of parties which pursue a compatible European policy agenda. This means that the framework conditions for the euro would re- main unchanged – and while political developments in Germany are quite important for us Germans, they will not have a major impact on the euro.

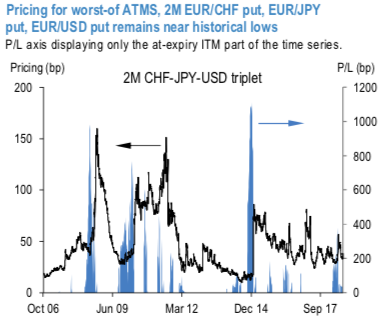

By considering a set of triplets of EUR-crosses in the G7 space, we would find that in a worst-of put structure, JPY, CHF and USD would be the one offering the least correlation discount (60%) vs the cheapest plain vanillas. By choosing the CHF, SEK, USD triplet, for instance, the correlation discount could rise to 80%, but the sensitivity to the BTP-Bund spread would typically find EUR to appreciate vs SEK on a higher level of spread, thus making the latter currency less suitable to be included in a EUR hedge trade.

The pricing of the structure remains competitive from a historical perspective (refer above chart), with the trade often delivering large PnL on the back of jumps in vols and/or correlations (with max leverage >10 times). We opt for 2% OTMS strikes for further cheapening the premium and structuring it as a proper tail-risk hedge. We consider 2M, 2% OTMS worst-of EURJPY put, EURCHF put, EURUSD put at 14/18.5 bps.

Alternatively, one could consider an implementation via dual-digitals involving just two EUR-crosses. Amongst the most sensitive EUR-crosses against the Italian yields, EURCHF lower EURUSD lower is the combination offering the highest maximum leverage (around 9 times). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 4 levels (which is neutral), while hourly JPY spot index was at 132 (bullish), CHF is at -3 (neutral), while articulating at (10:03 GMT). For more details on the index, please refer below weblink:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?