The main focus of this week is the ECB's monetary policy meeting that is scheduled on Thursday for the rate decision.

The ECB has signalled a dovish tone in its policy minutes, so additional loosening of monetary policy at its upcoming meeting on 10th March is expected.

While December's under-deliverance highlights the risk of disappointment, the deteriorating economic outlook should persuade the Governing Council to be quite more dovish this time.

A 20 bps cut in its deposit rate and a €20bn expansion of its monthly asset purchases are expected from this policy.

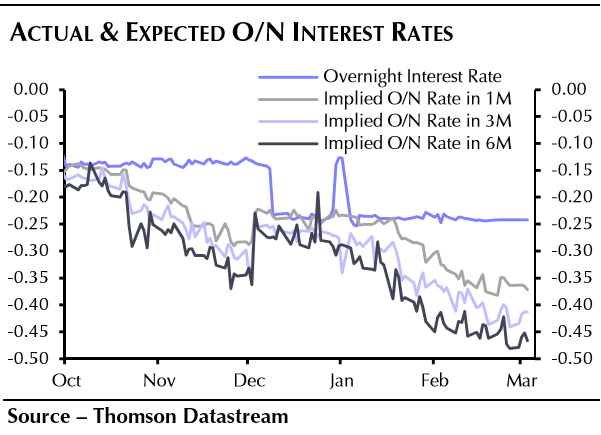

Accordingly, the interest rate swap markets appear to be anticipating a fall in overnight interest rates - and, hence, the ECB's deposit rate (see implied rates) - of a bit more than 10 bps at this meeting, with another cut in later months.

But a Reuters poll of economists also revealed a strong expectation of a rise in the ECB's asset purchases from the current rate of €60bn per month.

The median forecast was a rise to €70bn but the range was from €70bn to €90bn - i.e. all 66 respondents predicted a faster pace of asset purchases.

FxWirePro: Euro implied rates in swaps signal ECB monetary policy's dovish hopes

Tuesday, March 8, 2016 1:26 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?