Europe’s economic heart is pumping away and a 0.8% Q3 QoQ GDP gain in Germany threatens to nudge the Eurozone growth rate up too.

It’s a reminder of the changing of the guard as the US economic cycle ages and has given the euro a bit of a bid this morning as a backdrop for the marquee panel at today’s ECB Conference in Frankfurt, with Messrs Draghi, Yellen, Kuroda, and Yellen on stage.

EURUSD 1.1880 is the key level according to Stephanie, but the big challenge comes from the failure of the recent chop to lighten speculative euro long positions.

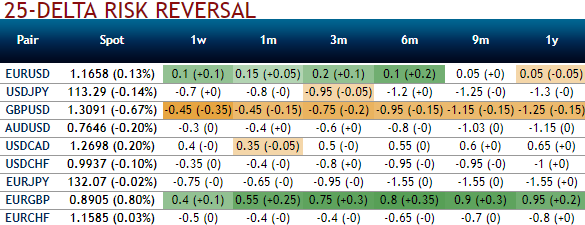

Please be noted that the risk reversals of EURJPY across all tenors are still indicating bearish risks, while positively skewed IVs of the same tenor signifies the hedgers’ interests in OTM put strikes upto 129 levels.

On the flip side, if you look at the technical chart of this pair, the major trend has been rising higher. The technical trend indicators have also been substantiating the continuation in this consolidation phase (refer monthly chart). For more reading, refer our technical section.

Fundamentally, the historical experience from valuation frameworks suggests that euro valuations are not yet a constraint for further strengthening. On long-term valuation metrics, even though the euro has strengthened by 15% in TWI terms since the post-QE bottom, historical experience from other major currencies where markets perceived an impending end of QE programs showed a larger, 26% strengthening in TWI on average.

Hence, keeping both fundamental and technical factors in mind, it is advisable to initiate below relative value trades.

Sell 6M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged.

Buy 3M 30D EUR puts/JPY calls vs. sell 3M 28D EUR puts/KRW calls.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 124 levels (which is highly bullish), while hourly JPY spot index was at shy above 3 (neutral) while articulating (at 11:00 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios