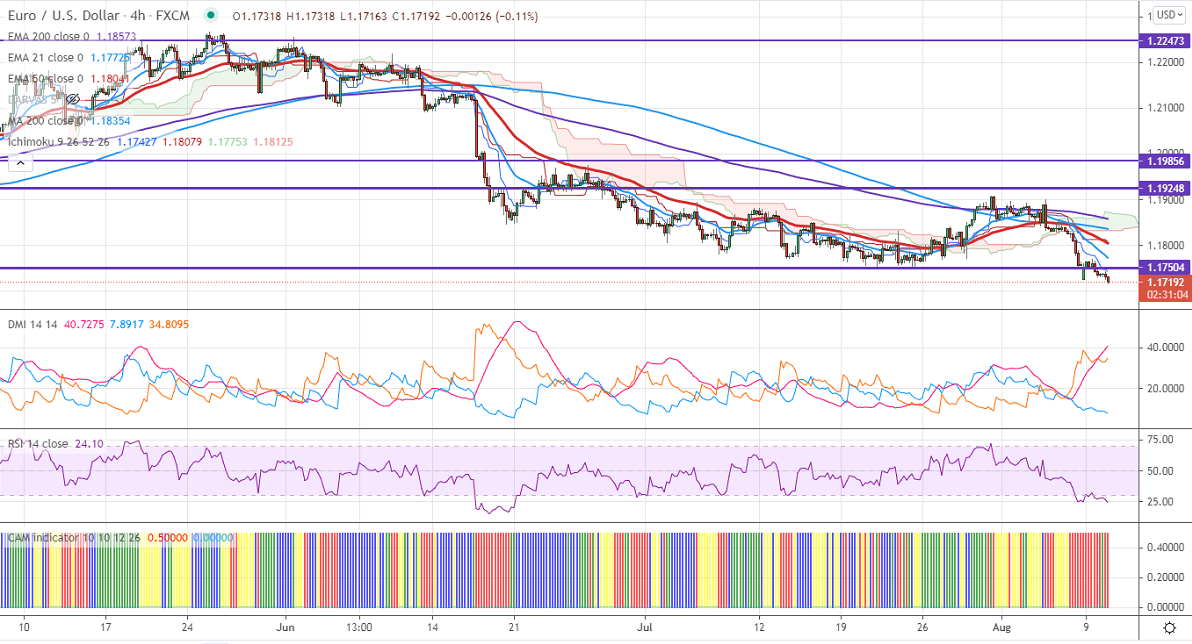

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.17469

Kijun-Sen- 1.18122

EURUSD declined sharply and hits a multi-month low on board-based US dollar buying. The weaker than excepted German ZEW sentiment also putting pressure on Euro. It declined sharply to 40.4 in Aug compared to a forecast of 54.90. The pair hits an intraday low of 1.17163 and is currently trading around 1.17212.

Technical:

On the higher side, near-term resistance is around 1.1760 and any convincing breach above will take to the next level 1.1800/1.1835/1.1865/1.1920. The pair's near-term support is at 1.1780, break below targets 1.1700/1.1660.

Indicator (4-hour chart)

CAM indicator-Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.1758-60 with SL around 1.1800 for the TP of 1.1660.