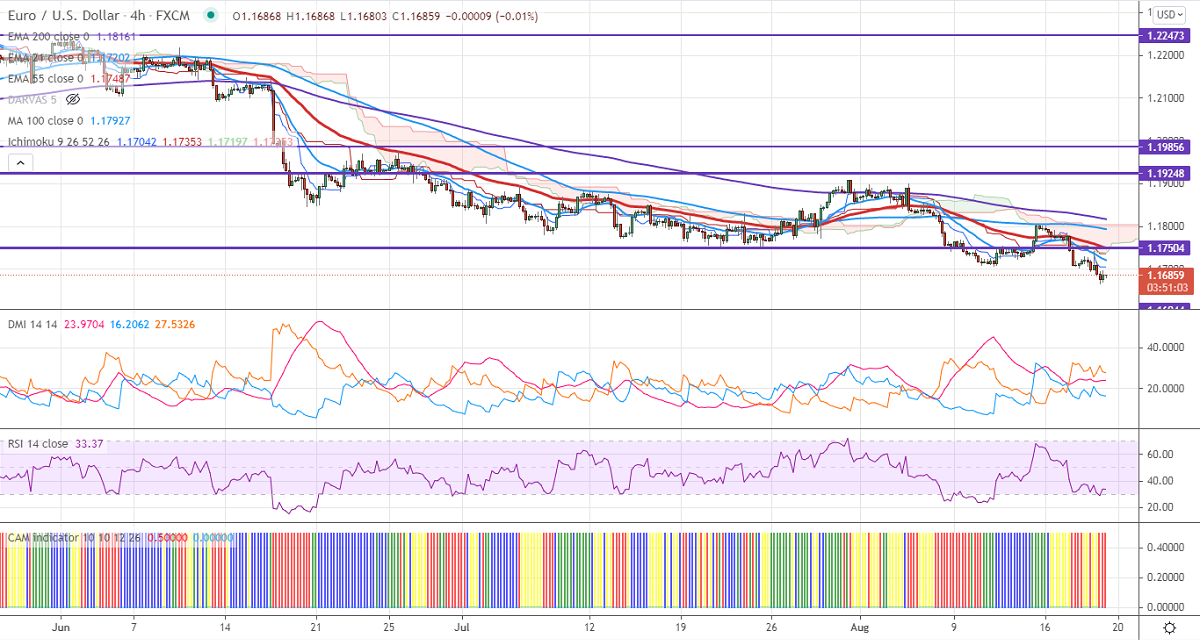

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.17042

Kijun-Sen- 1.17353

EURUSD declined below 1.11700 after Fed meeting minutes. It has signaled that the central bank to start tapering bond-buying by this year's end. The US dollar index reacted positively and hits a 4-1/2 month high. The rapid spread of Delta variant coronavirus and the Afghanistan political crisis also supporting the US dollar. Markets eye US Philly Fed manufacturing index and US initial jobless claims today for further direction. The pair hits an intraday low of 1.16658 and is currently trading around 1.16815.

Technical:

On the higher side, near-term resistance is around 1.1730 and any convincing breach above will take to the next level 1.1765/1.1800. The pair's near-term support is at 1.1660, break below targets 1.1600/1.15285.

Indicator (4-hour chart)

CAM indicator-Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.17480-50 with SL around 1.1800 for the TP of 1.1600.