- EUR/USD has shown a minor jump in European session after better than expected PMI data. The pair jumped till 1.17939 at the time of writing and is currently trading around 1.17821.

- The flash Markit Eurozone PMI came at 57.4 for Aug from 56.6 the previous month. It came slightly above expectations of 56.3.

- Markets are lacking clear direction ahead of Jackson Hole symposium which is to be started on Thursday.

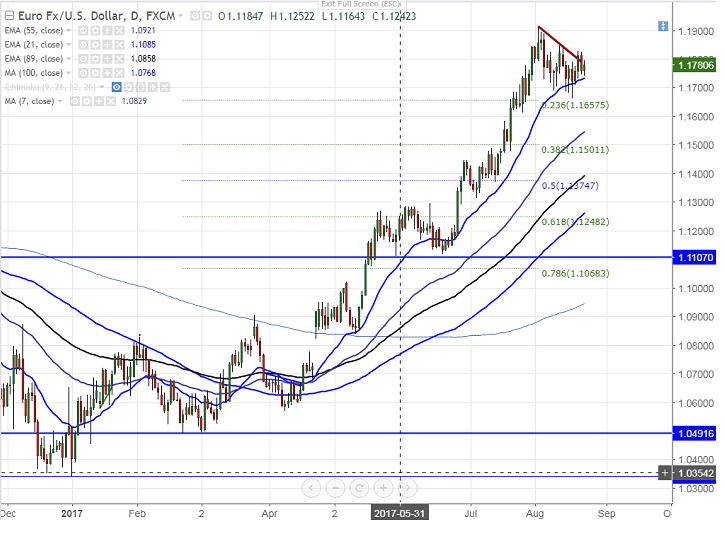

- On the lower side, near term support is around 1.16575 (23.6% retracement of 1.08930 and 1.19103) and any break below will drag the pair till 1.15985/1.1500. The minor support is around 1.1750/1.1680.

- The near term resistance is around 1.1850 and any break above will take the pair till 1.19103 (Aug 8th 2017)/1.19391 (1.13% retracement of 1.19103 and 1.16880)/1.1200.

It is good to buy on dips around 1.17000 with SL around 1.16500 for the TP of 1.1830.