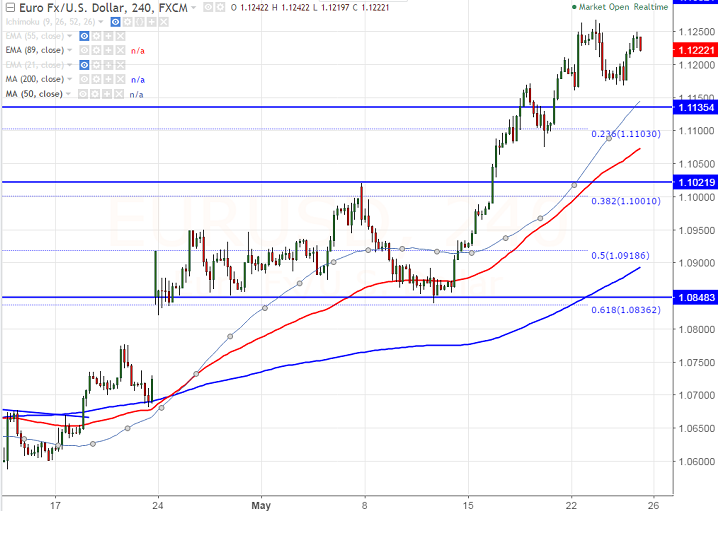

- Major support – 1.1160 (May 22nd 2017 low).

- EURO recovered sharply post FOMC minutes and hits 1.1250 level. The Fed minutes showed that members are supporting for gradual increase in rates and to cut back on the Fed’s $4.5 trillion. The pair downside capped by 4H Kijun-Sen at 1.1180 and any minor weakness can be seen only below that level.

- The pair near term resistance is around 1.12678 high made on May 23rd 2017 and any violation above will take the pair to next level till 1.1300 Nov 2016 high/1.13660.

- On the lower side, any break below 1.1180 will drag the pair down till 1.110 (23.6% retracement of 1.105694 and 1.12678)/1.1050/1.1000.

It is good to buy on dips around 1.1220 with SL around 1.1160 for the TP of 1.1299/1.1360.