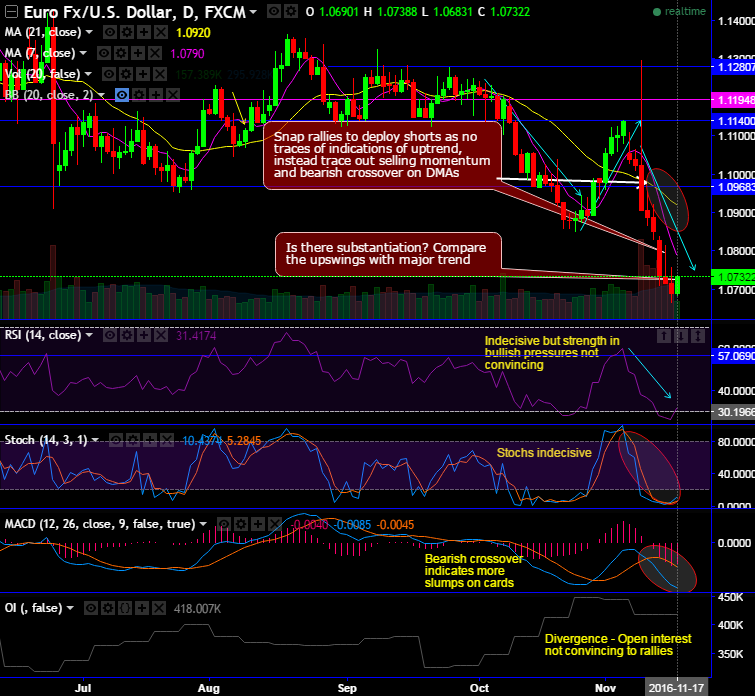

The pair surged to 1.0711, Wednesday’s 11-month trough of 1.06651 as dollar losing traction today, however, remained closer to the multi-year highs.

Snap rallies to deploy shorts as no traces of indications of the uptrend, instead trace out selling momentum and bearish crossover on DMAs.

Is there substantiation? Compare the upswings with major trend.

RSI remains near oversold territory and still indicates indecisiveness in prevailing trend, the strength in rallies has not been convincing.

Stochastic curves remain below oversold zone but still signals indecisiveness as there are no traces of %K crossover.

Bearish crossover indicates more slumps on cards.

Divergence - open interest not convincing to rallies.

The major non-directional trend now goes in bears' favor after sliding below EMAs and breaking major supports in last months' price declines.

Well, overall the dollar also remained largely cushioned by rising U.S. government bond yields and expectations for ramped up fiscal stimulus once Donald Trump becomes president.

Although the intraday rallies are encouraged, we see stiff resistance near 1.0790 (i.e.7DMA), hence, more slumps in the weeks to come are foreseen.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?