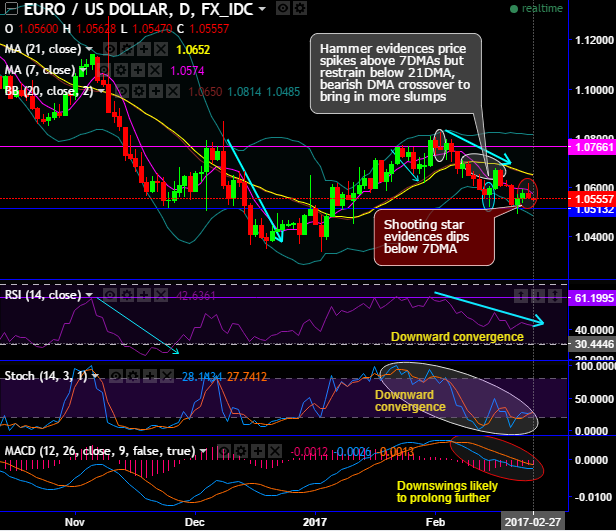

The hammer pattern occurred at 1.0599 levels and evidences price spikes above 7DMAs but restrain below 21DMA, for now again the same pattern is occurred at 1.0557 levels subsequently, we’ve seen the evidences of bull swings but restraining again at 7DMAs. Thereby, we can foresee the weakness in this pair on repetitive struggle at DMAs with bearish DMA crossover to bring in more slumps (daily charts).

Shooting star patterns occurred even at 1.1088 and 1.1575 levels on monthly ploting which is well below 21EMAs.

As the interim bulls seem to have exhausted at 7-EMA, we call for more slumps rather than bulls extending rallies upto channel resistance.

EURUSD major trend has been sliding through slopping channel (monthly terms). While last two days’ price upswings ever since bulls took support at 1.0513 levels have now begun losing traction (see daily charts).

Although EURUSD spiked from channel support, it has been struggling to bounce further above 21SMA levels on monthly; as a result, we’ve seen shooting star and doji pattern candles are occurred at 1.1088 and 1.1157 levels where stiff channel resistance is observed repetitively.

The shooting star pattern even on daily plotting evidences price dips below DMAs.

To substantiate this bearish stance, 21DMA crosses over 7DMA which is a bearish DMA crossover to bring in more slumps.

RSI on both daily as well as monthly terms indicates convincing strength in declining trend downward with its convergence to the prevailing price declines.

While stochastic curves have been indecisive but bearish bias at oversold zone (on both dailies and monthly terms).

MACD’s indicates indecisiveness on monthly terms but remains bearish biased on dailies.

It is wise to snap rallies to deploy fresh shorts as you see no traces of indications of the robust uptrend for now, instead trace out selling momentum on shorter term charts.

Trade tips:

Well, contemplating above technical reasoning, on speculative grounds we advise tunnel spreads which are binary forms of the bear put spreads.

At spot reference: 1.0555, this strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 1.0591 (around 30-40 pips) and lower strikes at 1.0513 levels (around 40 pips on southwards).