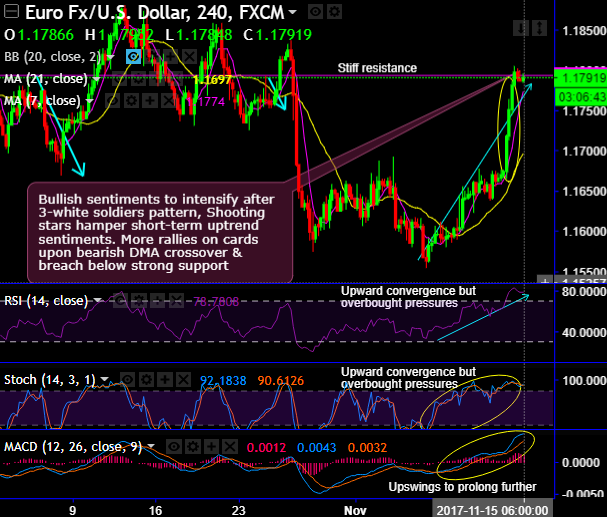

We foresee the bullish sentiments are likely to intensify especially after the formation of 3-white soldiers pattern.

On the flip side, the shooting star has occurred to hamper short-term uptrend sentiments. More rallies on cards upon the resurgence at the strong support 7EMA levels.

As and when you could see the formations of shooting stars, there has been considerable price slumps which is a slight caution for the aggressive bulls.

On a broader perspective, the bull swings have managed to break range resistance, although the short-term trend seems slightly edgy upon shooting star formation, the rallies likely to drag only upon support at 7EMA. And 7EMA crosses over 21EMA which is a bullish EMA crossover to indicate the continuation of consolidation phase in the major trend.

On the contrary, the trend may sense little weakness after shooting stars formation, the current prices are restrained below stiff resistance at 1.1794 levels during early European trading sessions. As the above stated bearish pattern may hamper short-term uptrend momentum as this is coupled with signals of overbought pressures from the leading oscillators. Consequently, the recent uptrend sentiment has been little edgy.

While both lagging indicators have been signaling extension of the uptrend (refer daily & monthly charts).

Currency Strength Index: FxWirePro's hourly EUR spot index is gaining traction displaying shy above 99 levels (bullish), while hourly USD spot index was inching lower towards -72 (bearish) while articulating (at 07:03 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

Hence, bulls may resume any time upon these indications.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?