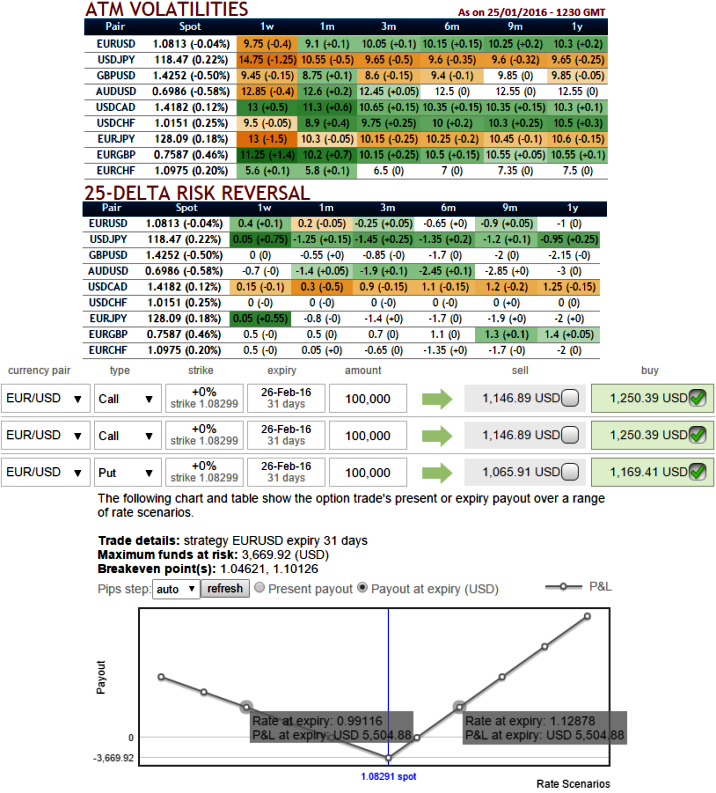

Hedging sentiments in OTC markets are retrogressive to what we've been seeing from last couple of months, to keep it precise we could notice neutral to slightly bullish hedging arrangements for next 1W-1M expiries (see risk reversals for 1W-1M expiries).

The implied volatility of ATM contracts with 1w-1m expiries inching lower and underlying pair shifting in range bounded trend turns previous negative risk reversals into positive for 1 week's expiries and neutral for 1 month's expiries. We urge that this situation as a rosy opportunity short term bulls as the neural delta risk reversals for next 1m contracts.

This could be attributed as bullish momentum is intensified in the spot FX market and overpriced calls eyeing on short term upswings but keeping overall major trend to prolong bearish noises. Hence, the strategies have to be constructed so as to match this fluctuating trend.

Although we could see a little price bounces in near term as the daily chart suggests some buying interest caused by whipshaws to the previous downswings that would result in some price recoveries but we maintain our target at 1.0709 levels towards south back again in medium term, same is the OTC market indications as stated above.

As a result, we recommend building portfolio with 2 lots of long positions in 1m 0.50 delta ATM calls and 1 lot of -0.49 delta ATM puts of 3m expiries.

Hence, this EURUSD option strips strategy should take care of any abrupt upswings in short term and certain downswings and yields handsome returns on the downside in long term.

Delta of far OTM options is very small which is why we've chosen ATM instrument on call. A 1-point movement in underling pair will not have much effect on the option premium.

FxWirePro: EUR/USD diagonal straps more suitable for risk averse

Tuesday, January 26, 2016 11:36 AM UTC

Editor's Picks

- Market Data

Most Popular