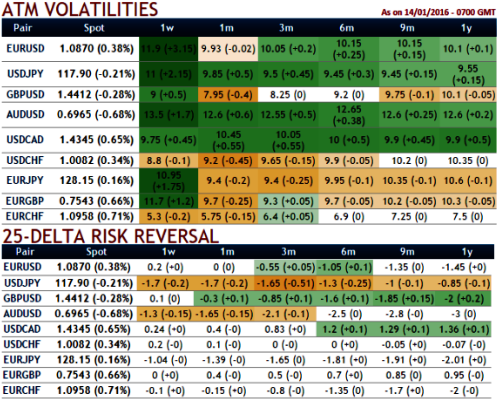

As you can observe from the table showing implied volatilities of ATM contracts edging higher which is highest among G10 currency space (EURUSD of 1W-1M expiries show 11.9% and 9.93%).

While risk reversal is seen positive numbers for next 1 week to 1 month's expiries, which means that an aggressively out of the money (OTM) option is often seen as a speculative bet/hedge that the currency will move sharply in the direction of the strike price.

It is unlikely for higher EURO's sustainability until there is real domestically generated inflation.

Any spikes in this pair in near term can be attributed as shorting opportunity in our back spreads.

So, by employing the Vega options can not only multiply the returns but also upbeat the implied volatility.

As shown in the diagram, contemplating the above risk reversal computations, we construct strategy comprising of both ITM as well as ATM puts in the ratio of 2:1 so as to suit the swings on either directions.

Capitalizing on higher IV and reasonnnable risk reversals in short run, ITM puts are attractive for shorting, so we can eye on shorting 1W (1%) in the money put that would lock in certain yields by initial receipts of premiums as upswings are likely in this pair.

Thereafter, go long in 2 lots of 1m ATM -0.48 delta puts with vega 124.62 are preferred to suit the long term losing streaks, thereby the spread would be executed for net debit and the cost is reduced by short side.

FxWirePro: EUR/USD diagonal PRBS for hedging swings with reduced

Thursday, January 14, 2016 1:49 PM UTC

Editor's Picks

- Market Data

Most Popular