Bearish scenarios: Below 1.07 if:

1) The market prices in three Fed rate hikes in 2018; or

2) Non-traditional parties prevail in German or Italian elections.

Bullish scenarios: Above 1.16 if:

1) Equity inflows accelerate into the region further;

2) Trade protectionism delays Fed tightening;

3) The US initiates a trade war with China, Mexico, Japan or the EU,

4) ECB becomes more hawkish

The EURUSD forecast for 3Q'17 is kept unchanged at 1.08 since it is overshooting rate differentials by 4%, the most in a year, and the possibility of early Italian elections. Beyond that, the focus is expected to shift to ECB taper which should push EURUSD to 1.15 in 4Q/ 1Q before edging higher to 1.16 in 2Q18 on expectations of an eventual ECB rate hike. The primary driver of the euro is expected to be an eventually less dovish stance by the ECB.

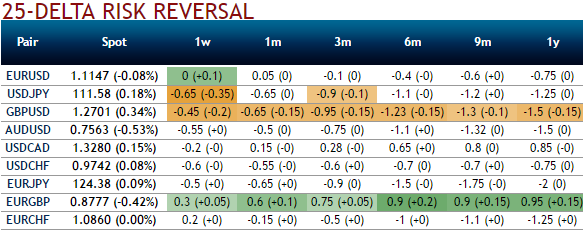

That would result in positive EURUSD risk reversals, or at least put an end to a persisting negative skew, with frequent flips from now on.

While the EURUSD skew stayed negative during the years of super-easy monetary policy, changes in FX skews are not unusual. For instance, the USDJPY 3m RR has traded on the positive side 23% of the time since start-2009, and the EURGBP 3m RR has been on each side exactly 50% of the time over the same period. The EURUSD 3m RR is currently nearly flat, while the 6m and 1y are lower than one vol for EUR puts. Crossing the line whereby euro calls become more expensive than puts may not be that far away.

With alleviating EUR downside risks, and given frequent flips in the EUR/USD skew before the Fed/ECB QE era, positive EURUSD risk reversals are an increasingly likely development.

Hence, buy EURUSD 6m call strike 1.15, European KI on the realized volatility at 9% Indicative offer: 0.60% (vanilla: 1.61%, volatility swap: 7.6%, spot ref: 1.1147).

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts