Bullish scenarios:

1) The ECB changes guidance in January/March, heralding an end to QE in Sept and hikes by 1Q’19.

2) US corporate repatriation is weaker/slower than expected,

3) Growth > 3%.

Bearish scenarios:

1) Concentrated, sizeable repatriation by US corporates EUR accounts for a third of foreign profits.

2) Draghi challenges impression of a prospective change to dovish forward guidance.

3) A squeeze on record speculative longs, possibly from a sell-off in global risk,

4) MS5 government in Italy or renewed elections after an inconclusive outcome.

But this list of EUR supportive factors is relatively extensive, which is why we have articulated a high degree of conviction in the forecast for further EUR appreciation.

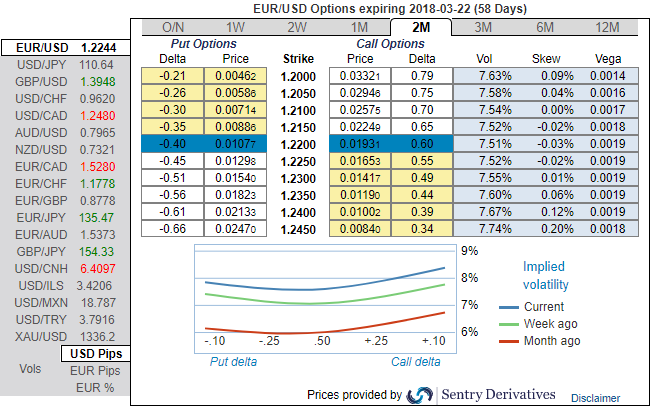

Well, all these fundamental developments are factored in EURUSD OTC markets.

Let’s glance at IV sensitivity tool that indicates mounting changes in the hedging sentiments on either side. This sentiment is substantiated by the positively skewed IVs of these tenors that have been signifying the hedgers’ interests of both OTM calls and OTM puts. Hence, this means that the ATM instruments have the likelihood of expiring in-the-money within their respective tenors.

Hence we advocate buying 3m options strangles comprising of 2m 0.5% OTM calls and 0.5% OTM puts of similar tenors on trading grounds.

Please glance at the payoff structure, as underlying spot FX surpasses barriers. Courtesy: JPM

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025