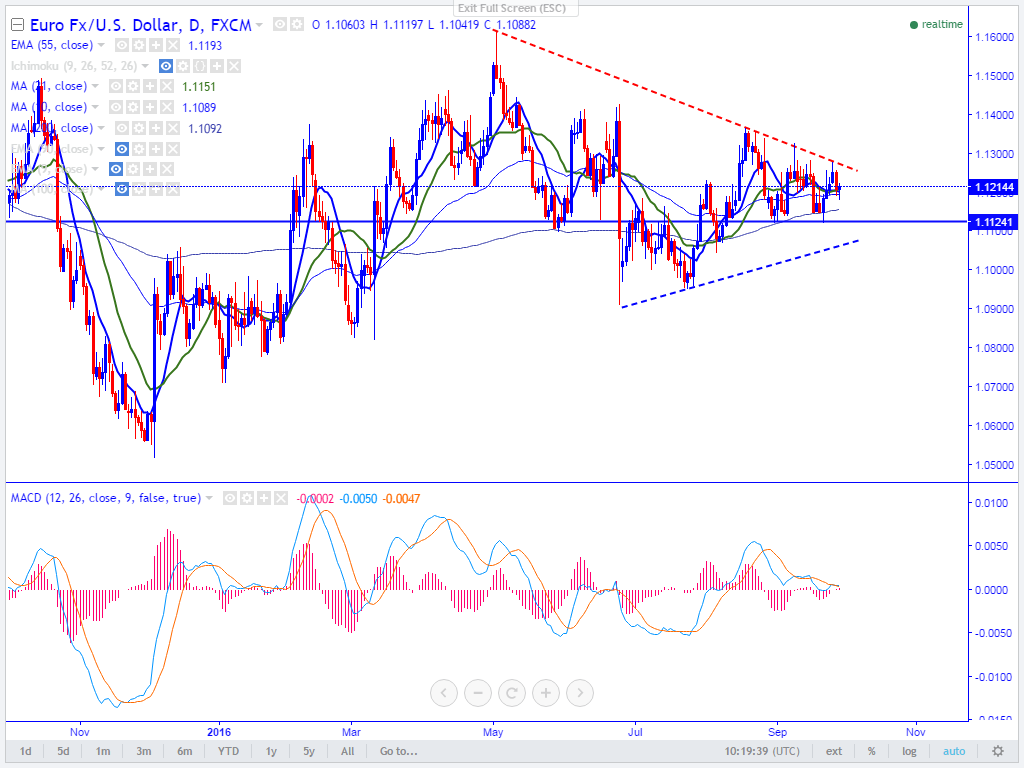

- Major Resistance – 1.1280 (trend line joining 1.16163 and 1.13660) .

- EUR/USD retreated sharply after making a high of 1.12588 yesterday. It is currently trading around 1.12163.

- The pair has broken major support at 1.1194 (55- day EMA) and declined slightly from that level till 1.11818 at the time of writing.

- The pair is facing strong resistance around 1.1280 (trend line joining 1.16163 and 1.13660)and any slight bullishness can be seen only above that level.

- Short term weakness below 1.1120 level.

- The major resistance is around 1.12800 (trend line joining 1.16163 and 1.13663) and any break above targets 1.13660.The minor resistance is around 1.1245 (daily Kijun-Sen).

It is good to sell on rallies around 1.1240 with SL around 1.1280 for the TP of 1.1150/1.112