The well anticipated French election outcome on April 24th saw the massive shrink in FX vols meaningfully below 1-day forward levels from last week’s close.

We remain comfortable fading political tail risks in Euro area.

The core inflation jumps in April due to Easter but March/April has also edged up.

ECB pleased on growth but cautious on inflation; accordingly, the European central bank prefers only incremental changes to its policy statement, reflecting caution on inflation.

The French election and US policy announcements dominated this week’s market movements. But for now, FX vols are materially lower than ex-ante forward roll expectations (refer above chart).

More than ATM vols or skews, however, EUR-based correlations should be the focus of attention for options investors. Second, we had flagged last week that EUR denominated correlations stood out as a better short than EUR vols themselves. This remains the case after this week's moves as the collapse in non-EUR vols has partially offset EUR developments, leaving EUR-based implied corrs with still-substantial corrective room from current levels (refer above chart).

EURUSD vs. EURCHF and EURUSD vs. EURJPY were the two most expensive correlation combinations going into the weekend vote given the potential for CHF and JPY to benefit from de-leveraging alongside a cratering Euro in the event of a market-unfriendly outcome after the first round election results, and therefore also have the maximum downside - a meaty 1520 % pts. to re-align with historical averages.

We had entered into a USDCHF – EURCHF option spread last week as a zero-cost conditional EUR recovery play which we continue to hold; we also initiate a USDJPY vs. EURUSD gamma spread as a reduced form expression of the EUR-USD-JPY correlation triangle.

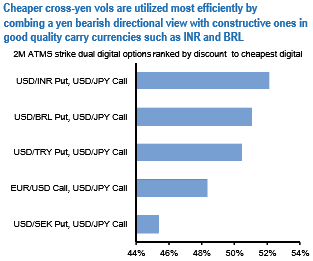

JPY which is the cheapest gamma to be found anywhere in FX and is the most sensitive to gyrations in Treasury yields that may result from a pickup in headline noise around tax/fiscal reform in the US with the Congress had returned from recess.

As a pair trade, USDJPY 1M ATMs vs. 1M 25D EUR puts/USD calls (delta-hedged) are favorably priced 1.0 –1.5 pts. below recently realized vols.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation