EUR/USD’s non-directional pattern is persisting from more than last one year or so, but some bullish neutral indications are observed, slight bearish pressures can be seen in the months to come, hence, there is a massive collapse in implied volatilities as well an OTC FX market.

From here onwards the pair should keep the consolidative theme in the weeks to come.

As highlighted yesterday, despite the improved shorter-term indicators, it is not enough to suggest the start of a sustained up-move in EUR.

On northwards, as long as 1.1120 can hold, another attempt to move higher towards 1.1461 is not ruled out even though the vision for such a move has lowered after the brief pull-back today soon after German upbeat GDP data.

Overall, the neutral phase remains intact and only a clear break out of the expected 1.1020/1.1260 sideway trading range would indicate the start of a sustained directional move.

OTC Outlook and Option Strategy:

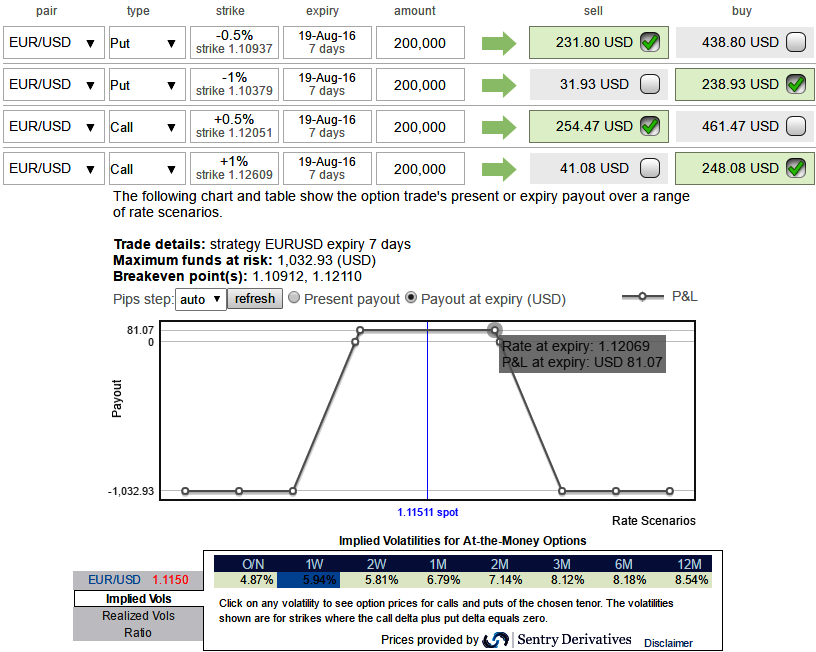

1W ATM IVs are at least levels (shy below 6%) with neutral risk reversal sentiments, we foresee the chances of the sideway trend to prevail further.

Since the EURUSD's implied volatility is perceived to be comparatively minimal from other major G7 pairs and neutral risk reversal sentiments, speculators in this range are on competitive advantage, accordingly, we construct a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

Just a fortnight ago, we had advocated iron condor option strategy and it seemed to have fetched the desired yields as the trend moving still in choppy range.

Well, we continue to use the same options expiring on the same expiration month, the option trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call. This results in a net credit to put on the trade.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025