The eurozone economic growth has slowed and there are risks of a recession.

The ECB, for the near future, ceased QE-related bond purchases in December, but there are risks any tightening will be delayed if growth slows materially. We revise our forecast for Q2 from 1.65 to 1.7050 levels.

RBNZ, on the flip side, is scheduled for its first monetary policy, which is most likely to maintain status quo in its OCR rates as the governor Orr had stated in the previous meetings that the OCR would need to be on hold until 2020 in order to sustainably hit the inflation target. Although Kiwis dollar slightly gains upside traction, major downtrend remains intact. We listed out some driving forces of EURNZD’s bullish risks:

1) The NZ housing market slowdown becomes disorderly;

2) Kiwis immigration rolls over more quickly;

3) Weak business confidence sees firms dramatically cut hiring.

4) US Fed concludes the hiking cycle but with European growth back above 2% (more 2006 than 2000;

5) The continued robust CB demand for EUR.

OTC outlook and Hedging Strategy:

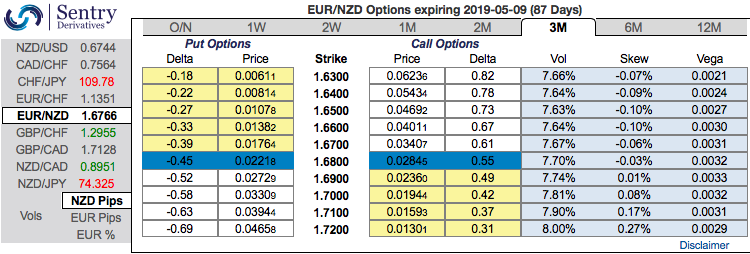

Please be noted that the positively skewed IVs (implied volatilities) of 3m tenors signify the hedgers’ interests in the upside risks (refer above nutshell). Bids for OTM calls strikes up to 1.72 levels are observed ahead of RBNZ monetary policy.

Contemplating all the above factors, we could foresee the upside risks of this pair. Hence, we advocate 3m (1%) in the money delta call options.

Thereby, in the money call option with a very strong delta will move in tandem with the underlying spot fx.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 15 levels (which is mildly bullish), NZD at -84 (highly bearish) while articulating (at 14:02 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis