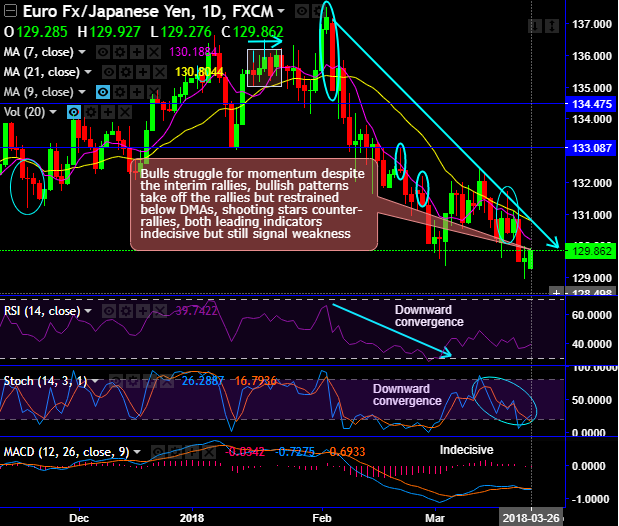

Chart and candlestick pattern formed- Bearish RSI divergence, shooting stars at 130.417 on daily terms and 132.336 levels on monthly terms. Hanging man patterns at 135.157 and 135.523 levels on the monthly chart, bearish engulfing patterns have occurred at 129.520 levels.

On a broader perspective, bulls break-out at 61.8% Fibonacci retracements but couldn't sustain, Shooting star, hanging man & engulfing patterns occur at peaks, both leading signal OB pressures, whereas lagging indicators yet to confirm. Consequently, these bearish patterns signal weakness.

One can easily make out the RSI evidences the bearish divergence to the price rallies so far, while fast stochastic curves pop up with %D crossover to signal intensified selling momentum.

The major supports are observed at 134.475 and 133.087 levels that are broken below these levels, while the next immediate strong support is seen at 129.828 levels.

Momentum oscillators on both timeframes have been indecisive but pop up overbought pressures, whereas the trend indicators are still indecisive.

Momentum study: As both leading oscillators (RSI signaling bearish divergence & stochastic curves show %D crossover) are slightly indecisive for further buying sentiments but evidence overbought pressures, thus the strength and the momentum in prevailing buying interests seem to be quite dubious.

Trend indicators: MACD on monthly terms has still been showing bullish crossover indicates indecisiveness to the further upswings.

Trade tips: On trading perspective, it is advisable to buy tunnel spreads that are binary version debit put spreads using upper strikes at 130.190 and lower strikes at 129.276 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping but remains above lower strike on expiration.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -40 levels (which is bearish), while hourly JPY spot index was at 69 (bullish) while articulating at 06:40 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

The above indices are also conducive to our binary options strategy.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings