EUR/JPY chart - Trading View

Spot Analysis:

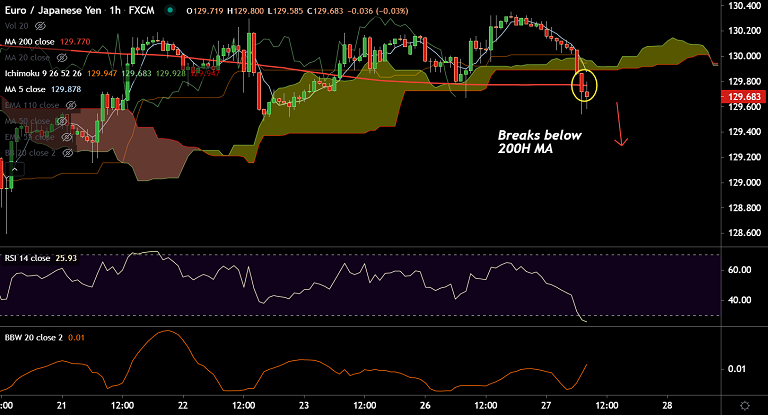

EUR/JPY slumps over 0.50% and was trading at 129.60 at around 08:30 GMT

Previous Session's High/Low: 130.35/ 129.67

Previous Week's High/Low: 130.29/ 128.59

Fundamental Overview:

Mixed European Central Bank (ECB) views, along with poor German IFO data keep the single currency under pressure.

Expectations that the ECB will remain dovish for a few more quarters, amid rising worries about the spread of the Delta variant add to the bearish pressure.

On the other side, the Japanese yen gained on its safe-haven appeal amid rising coronavirus delta variants.

Later in the euro docket, the ECB’s M3 Money Supply and Private Sector Loans figures will be in focus for impetus.

Technical Analysis:

- The pair has ignored the 'Hammer' formation on the previous week's candle and is extending weakness

- GMMA indicator shows minor trend is turning bearish again while major trend is extending the bearish shift

- Price action has broken below 200H MA and volatility is rising on the intraday charts

- Stiff resistance seen in the 130.40 to 130.45 range, upside capped below

Major Support and Resistance Levels:

Support levels - 130.44 (110-EMA), 131.04 (55-EMA), 131.17 (23.6% Fib)

Resistance levels - 129.34 (38.2% Fib), 129, 128.50 (200-DMA)

Summary: EUR/JPY resumes weakness, ignores previous week's 'Hammer' formation. The pair finds stiff resistance at 21-week EMA. Scope for more downside, next immediate support lies at 38.2% Fib at 129.34.