EUR/JPY chart on Trading View used for analysis

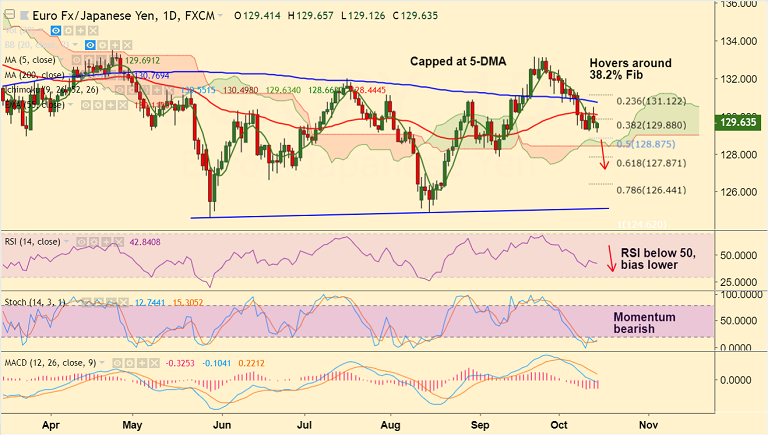

- EUR/JPY recovery attempts capped below 5-DMA at 129.68, bias bearish.

- The pair edges higher from session lows at 129.12, but upside lacks momentum.

- Technical analysis supports bearish bias. Price action is likely to extend weakness after break below 200-DMA.

- Momentum highly bearish, Stochs and RSI are sharply lower and MACD supports weakness with bearish crossover on signal line.

- Price action is now below major moving averages which have turned downward.

- Italian budget uncertainty to keep downside pressure on the single currency. Scope for dip till daily cloud.

- Breach at daily cloud support to see further weakness till 61.8% Fib at 127.87.

Support levels - 129.02 (Lower BB), 128.87 (50% Fib), 128.66 (cloud top)

Resistance levels - 129.69 (5-DMA), 129.88 (38.2% Fib), 130.76 (200-DMA), 131.12 (23.6% Fib)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-EUR-JPY-Trade-Idea-1440202) is progressing well.

Recommendation: Stay short for further weakness.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.