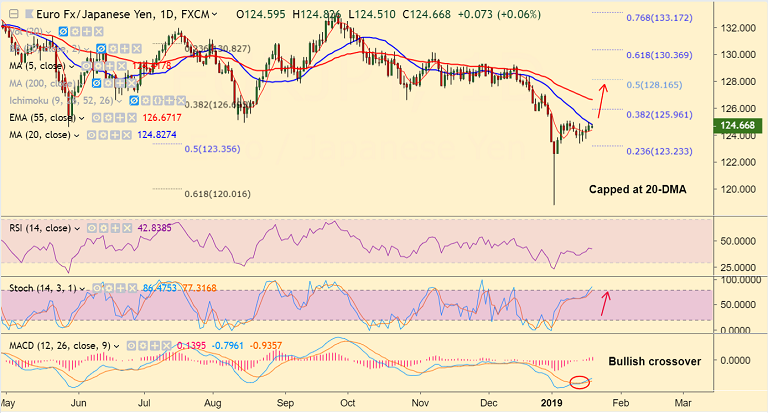

EUR/JPY chart on Trading View used for analysis

- EUR/JPY capped below 20-DMA resistance at 124.826, break above could see minor upside.

- Major trend in the pair remains bearish, price action below major moving averages.

- We do not see any major signs of reversal. Break above 20-DMA could see minor upside.

- Focus on European Central Bank (ECB) and Bank of Japan (BoJ) policy decisions due this week for clear directional bias.

- Slowdown in the Eurozone economy could force the ECB to delay rate hikes and rising odds of rate hike delay could keep the EUR under pressure.

- The central bank is seen raising its deposit rate, currently at -0.40%, to -0.20% in Q4 and would wait until early 2020 to raise its refinancing rate from zero to 0.20%.

- Stochs are biased higher and MACD is showing a bullish crossover on signal line. Breakout at 20-DMA could see test of 21-EMA at 125.14 ahead of 38.2% Fib at 125.96.

- Breakout at 55-EMA could see upside continuation.

- Immediate support is seen at 5-DMA at 124.41. Rejection at 20-DMA and break below 5-DMA could see dip till 23.6% Fib at 123.23.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.