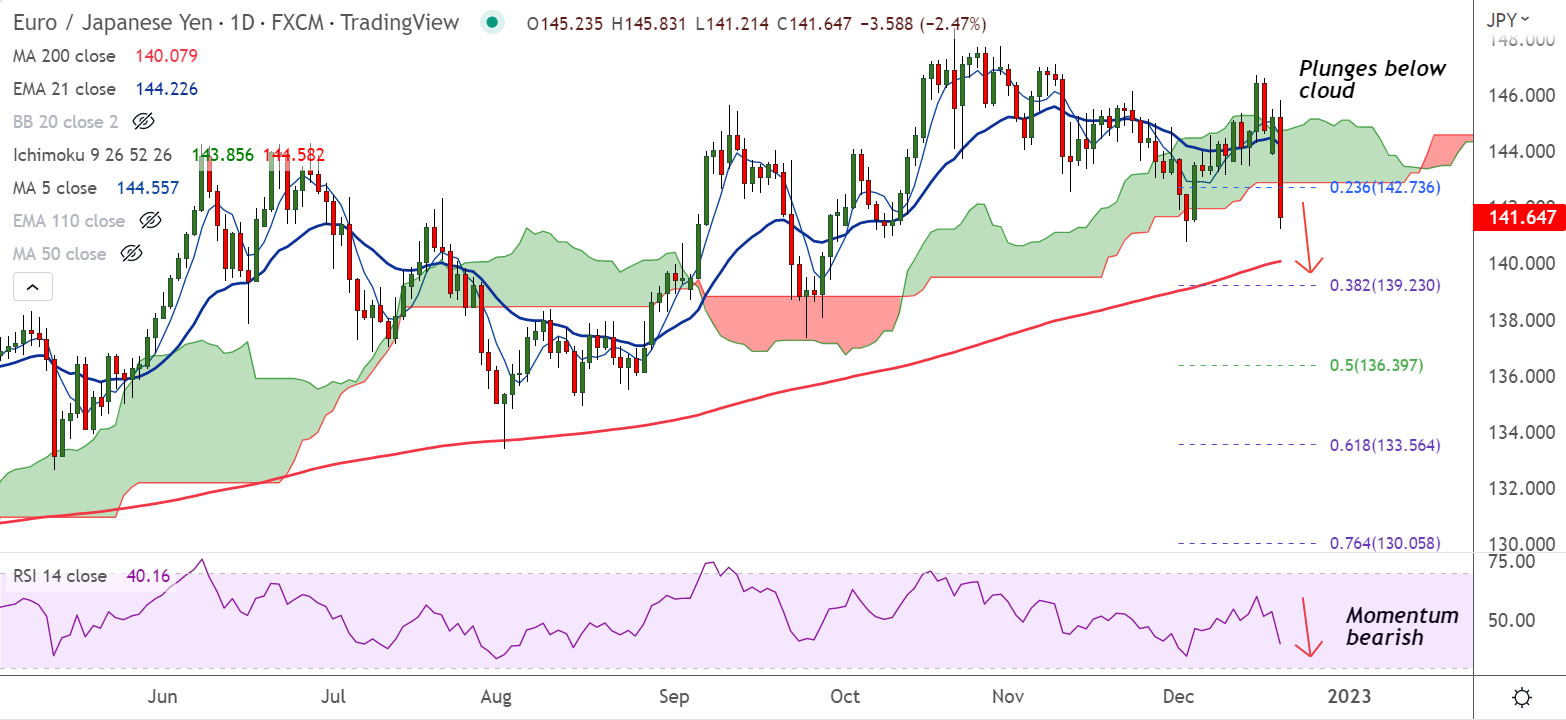

Chart - Courtesy Trading View

EUR/JPY was trading 2.47% lower on the day at 141.63 at around 04:35 GMT, slightly above session lows at 141.21.

Bank of Japan (BOJ) kept the benchmark interest rate unchanged at -0.10% as expected, but widened the range for yield fluctuations in the benchmark government bonds.

The move lends credence to speculation that the BoJ could eventually tighten policy in the face of high inflation and Yen bulls cheer the Bank of Japan’s (BOJ) alteration to yield target.

The central bank said it will raise the range of 10-year Japanese Government Bond (JGB) yield fluctuations to between negative 0.5% and 0.5%, from a range of negative 0.25% to 0.25%.

Focus going forward will be on BOJ Governor Kuroda’s speech for fresh impulse. Hawkish BOJ concerns could further weigh on the prices.

On the euro zone data front, focus will be on Germany’s Producers Price Index (PPI) for November, expected at -2.6% YoY, versus -4.2% prior.

Major Support Levels:

S1: 140.07 (200-DMA)

S2: 139.23 (38.2% Fib)

Major Resistance Levels:

R1: 142.46 (110-EMA)

R2: 143.91 (55-EMA)

Summary: EUR/JPY plummeted below the daily cloud and 23.6% Fib retracement. Technical indicators are turning bearish. The pair is on track to test 200-DMA at 140.07.