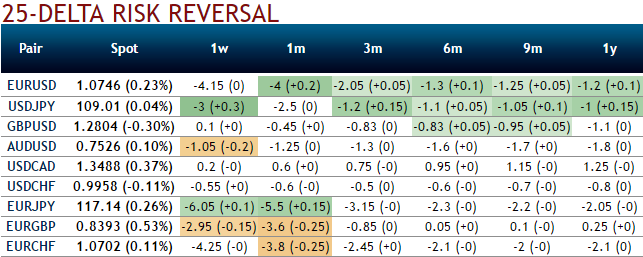

As the delta risk reversals of euro crosses (especially in EURJPY) have shown a mounting bearish interest as the progressive increase in negative numbers signify the traction for hedging sentiments for further downside risks in both short and long term. EURJPY is the highly perceived pair to have bearish risks (see for the highest negative numbers among G10 space).

To substantiate this bearish stance, positively skewed IVs of 1m tenors are signifying the hedgers’ interests in OTM put strikes. This implies underlying spot likely plummet further southwards.

Since EURJPY OTC markets seem to be the highly volatile pair as well with the extremely bearish environment, and IVs for 1M contracts are the highest among G10 FX space (above 17%) amid European election season. This would be good news for option holders contemplating the prevailing bearish environment but more number of longs in ATM delta puts would ensure the reasonable probabilities in underlying exposures.

To factor in the weakness in this pair as we could see reasonable IVs even in next 1-3m expiries, we recommend capitalizing more on bearish signals and the IV factor in the long term by employing OTM longs matching with ATM longs to construct back spreads that likely to fetch positive cash flows.

So, here goes the strategy this way, Go long in 1 lot if 1M ATM vega put, long in 2M (1%) OTM vega put, and simultaneously short 1W (1%) ITM put, the spread is to be executed in the ratio of 2:1 with net delta at around -0.70. Vega instruments during highly volatile environment are most likely to fetch beyond usual yields when underlying spot keeps moving anticipated directions.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis