Funds and real money accounts sold EUR and GBP, while trimming their JPY shorts slightly. These moves should have extended post the cut-off date, on concerns over impact of Turkey’s crisis on EU banks and talks of a no-deal Brexit.

Do you notice something? Monetary policy has taken a back seat. Comments about monetary policy by anyone in leading positions are hard to come by at the moment, as if everything had already been said. No doubt that is not the case, but many central bank members seem to have gone on holiday and only some of them seem to get onto a stage or in front of a microphone. And even if they do comment, market interest is limited. The market’s main focus these days is the threat of a global trade conflict.

The ECB, in the recent past, did announce the end of the asset purchases, but an actual end of the expansionary monetary policy is not really in sight. Rate hikes, which are what the market really wants to see, are still a long way off, as the ECB has pointed out very clearly. It can therefore not be assumed that Draghi will move the markets to the same extent today as he did last year.

OTC outlook:

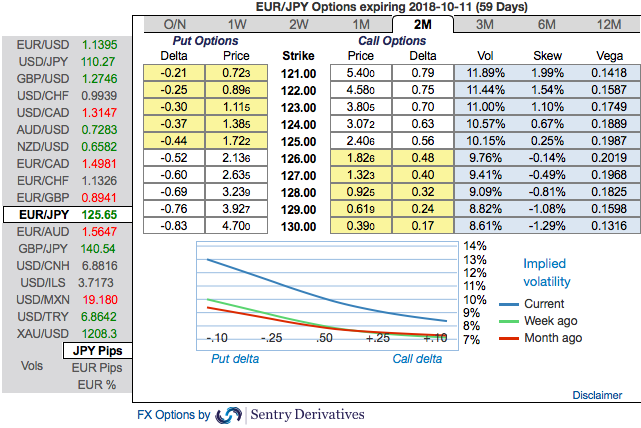

Most importantly, please be noted that the positively skewed IVs of 2m tenors are signifying (1.99) the hedging interests in the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 121 levels so that OTM instruments would expire in-the-money.

While negative risk reversal numbers of all euro crosses (especially EURJPY) across all tenors are also substantiating increased bearish risks in long run.

Technically, we already raised red flags about EURJPY bearish risks.

Options strategies for hedging:

Contemplating above fundamental driving forces and OTC indications, we’ve devised various options strategies:

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders.

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders. Courtesy: CFTC, ANZ

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -38 levels (which is bearish), while hourly JPY spot index was at 96 (bullish) while articulating at (07:09 GMT). For more details on the index, please refer below weblink:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed