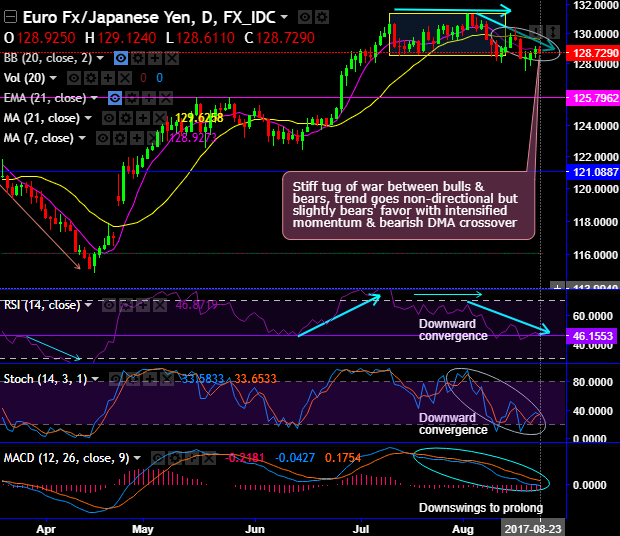

You could very well observe ever since EURJPY swings form shooting star pattern at 129.6060 levels, the bears manage to slide below DMAs constantly despite the stiff tug of war between bulls & bears. As a result, the trend, for now, goes slightly in bears' favor with intensified momentum

But from the last couple of days, the trend remained in sideways (refer rectangular portion on the daily chart) but for now, with bearish DMA crossover even if you see any further slumps, it should not be panicky as the major trend goes in the consolidation phase.

Both leading oscillators on daily terms have been indecisive but converging downwards as the trend goes in the southward direction, as a result, it is deemed as weakness in this pair.

On the contrary, we foresee the major trend in consolidation phase still seems to be intact as the bullish swings in this phase break-out 50% Fibonacci retracements. The bulls could not sustain multi-months’ highs after retracing this significant Fibonacci levels. The rallies likely to extend further on bullish EMA crossover (refer monthly charts).

Both leading oscillators (RSI & stochastic curves), on this timeframe, have been converging upwards but slightly indecisive for now in the overbought territory.

The current MACD curves are popping up bearish signals on daily terms and the same has signaled bull swings to prolong further on monthly terms but remains in bearish trajectory.

Trading tips:

Contemplating above technical reasoning, for intraday trading perspective, it is advisable to buy one-touch binary options that are leveraged products.

The strategy is likely to fetch magnified effects on the yields as long as underlying spot FX keeps dipping on or before the binary expiry duration.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing 58 (which is bullish), while hourly JPY spot index was at -57 (bearish) at 04:45 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: