- EUR/JPY spikes past 122 handle, intraday bias remains higher.

- The single currency remains bid in Asia as markets cheer Draghi’s overall cautious yet positive tone.

- The sell-off in the Japanese Yen on account of the rising Treasury yields pushed the pair higher.

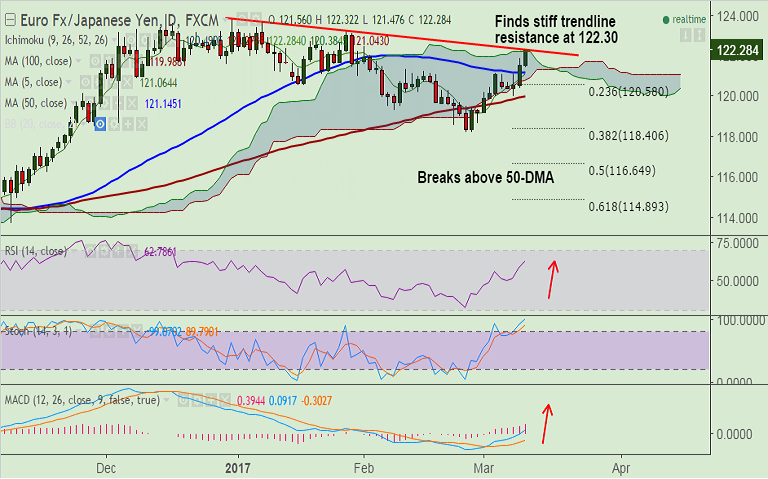

- Technical studies support upside. The pair has broken past 50-DMA at 121.14.

- Upside finds major resistance at 122.30, break above could see further upside.

- Markets focus on German current account surplus due later today.

Support levels - 122, 121.14 (50-DMA), 121.06 (5-DMA)

Resistance levels - 122.30 (trendline), 122.95 (Ja n 20 high), 123.31 (Jan 27 high)

TIME TREND INDEX OB/OS INDEX

1H Bullish Overbought

4H Bullish Overbought

1D Bullish Neutral

1W Bullish Neutral

Recommendation: Good to go long on breakout above 122.30, SL: 121.85, TP: 122.95/ 123.30/ 123.70

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 118.353(Highly bullish), while Hourly JPY Spot Index was at -150.259 (Highly bearish) at 0600 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.