- Markets dominated by risk-off after North Korea warned of a nuclear strike should the US provoke them.

- Yen supported by safe-haven flows in early Asia, but recovery in UST yields halted yen upside.

- EUR/JPY is trading a narrow range after slump on Tuesday. Doji formation seen on daily charts as we head into the EU session.

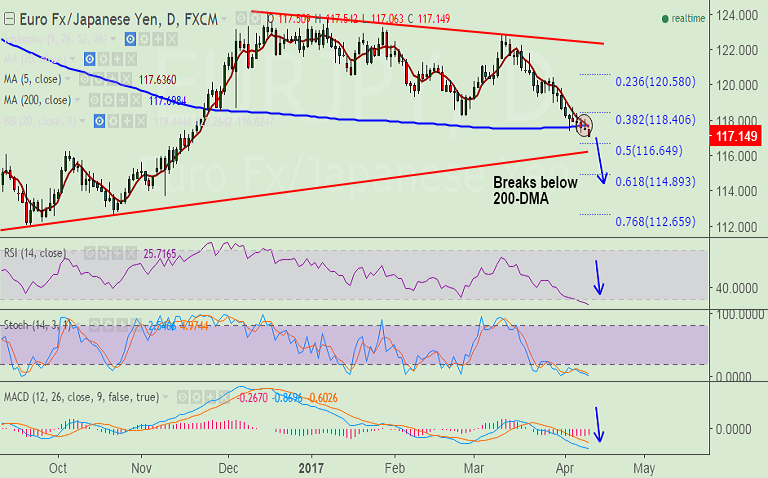

- The pair has broken below 200-DMA and more slumps on cards.

- We see major trendline support at 115.70, further weakness only on break below.

- On the flipside, bearish invalidation if the pair retakes 200-DMA at 117.70.

Support levels - 115.70 (trendline), 114.89 (61.8% Fib retrace of 109.205 to 124.094 rally), 114.01 (Nov 3rd 2016 low)

Resistance levels - 116.65 (50% Fib), 117.09 (5-DMA), 117.70 (200-DMA)

TIME TREND INDEX OB/OS INDEX

1H Neutral Neutral

4H Bearish Neutral

1D Bearish Neutral

1W Bearish Neutral

Call update: Our previous call (http://www.econotimes.com/FxWirePro-EUR-JPY-hovers-around-200-DMA-good-to-go-short-on-close-below-11750-634780) has hit all targets.

Recommendation: Book full profits at lows. We advise fresh shorts only on break below trendline support at 115.70

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at -25.283 (Neutral), while Hourly JPY Spot Index was at 48.9352 (Neutral) at 0620 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.