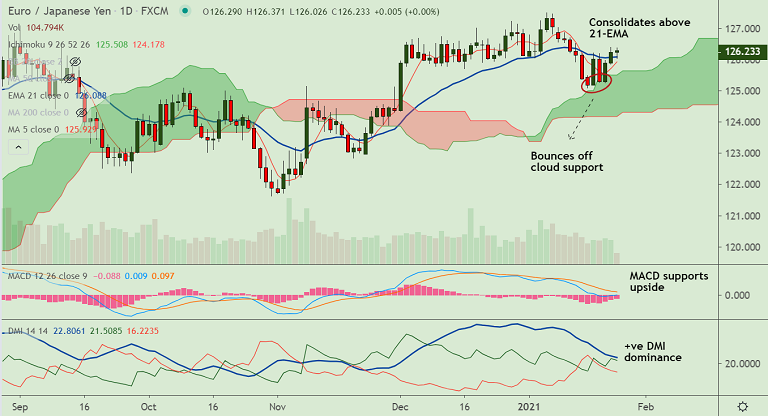

EUR/JPY chart - Trading View

EUR/JPY struggles to extend gains above 21-EMA, as disappointing German IFO survey results failed to provide any support to the euro.

The pair was trading largely unchanged at 126.23 at around 11:30 GMT, with session high at 126.37 and low at 126.02.

Data released earlier Monday showed the headline German IFO Business Climate Index fell sharply to 90.1 in January, missing estimates of 91.8 and compared to last month's 92.2.

Meanwhile, the Current Economic Assessment printed at 89.2 points as compared to last month's 91.3 and 90.6 anticipated.

The IFO Expectations Index eased to 91.1 in January from the previous month’s 93.0 reading and worse than the market expectations of 93.2.

Technical bias for the pair has turned slightly bullish on the daily charts. The pair has edged above 21-EMA and 5-DMA has turned.

A "Golden Cross" (bullish 50-MA crossover on 200-MA) is likely to limit downside in the pair. Break above 20-DMA resistance to see further upside.

Resumption of upside will see test of 61.8% Fib at 128.67. 21-EMA is strong support at 126.08. Bullish invalidation only below 200W MA.