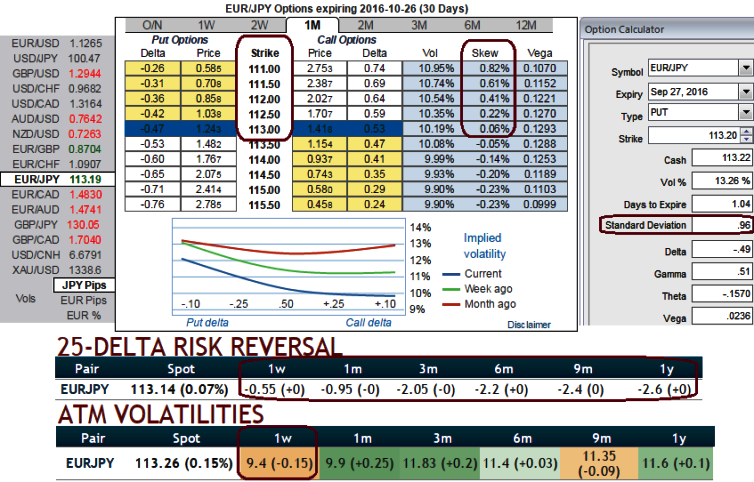

EURJPY IVs of 1w tenors have reduced to below 9.5% after BOJ’s shift in its monetary policy stance, while risk reversals still indicate the bearish hedging sentiments in the FX OTC markets.

From these risk reversal numbers, the hedging framework can individually be tailored, structured to mitigate the risk associated with the FX exposures. You can define:

The risk reversal allows for a customized hedging solution, tailored to your risk and hedging profile. Risk reversals are OTC derivative instruments and the notional amount does not need to be tied up throughout the full tenor of the trade.

Moreover, the IVs of 1m tenors have been positively skewed on OTM put strikes that signify the sentiments of hedging for the bearish pressures in this pair. On the other hand, the standard deviation of current ATM puts are at 0.96. We see IVs have fallen in a range that is in sync with standard deviation, for an instance, synthesizing IV skews (with spot rates) at strikes 112.50 are 0.22%, even if calculate forward rates factoring this skewness it remains well within standard deviation.

Thus, we urge you to be mindful as to how to factor it into your trading strategy you are unlikely to win long term.

Standard deviation is logical, easy to comprehend and would help you time entries better and define targets for trades, as well as spotting important trend reversals and indicates the volatility of price in any currency. In essence, standard deviation measures how widely values are dispersed from the mean or average.

Fundamentally, amid the apprehensions on perimeters of the policy arsenal at the ECB and rising euro-centric risks, we recommend maintaining shorts positions in EURJPY for medium term hedging but by capitalizing on every short-term upswing, preferably via options.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand