Ahead of the ECB meeting on Thursday, it is clear that not all ECB members are comfortable with its calendar-based guidance, and we would expect ECB rhetoric to evolve in a less dovish fashion assuming that the economy can get back on track, and stay there.

What some people may have forgotten is that on this exact day, six years ago, 26 July 2012, ECB president Mario Draghi said what is likely to be the most important words in recent European monetary policy history: 'Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.'

Since the famous words, ECB has taken a number of initiatives, and with its boldest project, the asset purchase programme anticipated to conclude by the end of the year

The ECB, in the recent past, did announce the end of the asset purchases, but an actual end of the expansionary monetary policy is not really in sight. Rate hikes, which are what the market really wants to see, are still a long way off, as the ECB has pointed out very clearly.

Bearish EURJPY scenarios (see 128) if:

1) The euro area growth fails to rebound above 2%

2) EUR appreciation and/or sluggish core CPI delays ECB policy normalization

3) The BoJ does not move even if the core inflation rate rises more than expected.

OTC outlook:

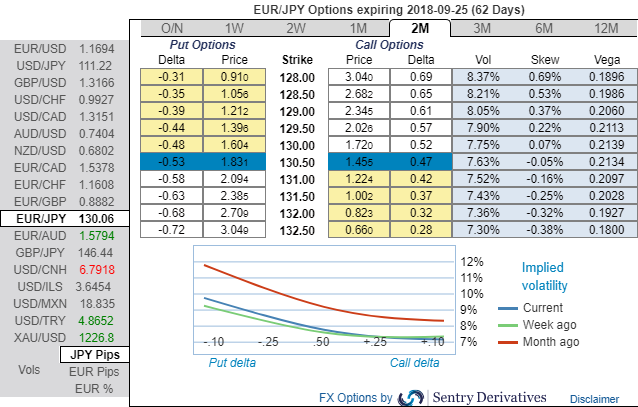

Most importantly, please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests in the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 128 levels so that OTM instruments would expire in-the-money.

While the increased negative risk reversal numbers of all euro crosses (especially EURJPY) across all tenors are also substantiating bearish risks in long run amid minor abrupt upswings in the short-term.

Options strategies for hedging:

Contemplating above fundamental driving forces and OTC indications, we’ve devised various options strategies:

Buy 2M EUR puts/JPY calls vs sell 2M 28D EUR puts/KRW calls for directional traders.

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -60 levels (which is bearish), while hourly JPY spot index was at 52 (bullish) while articulating at (08:06 GMT). For more details on the index, please refer below weblink:

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts