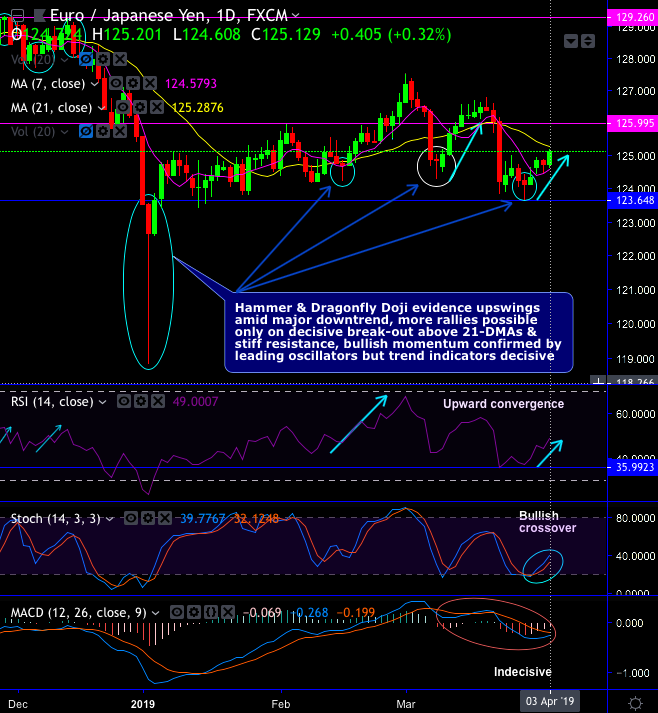

The interim trend: EURJPY forms hammer and dragonfly doji pattern candles at 124.133 and 124.275 levels respectively on daily terms, and hammer at 124.601 level on monthly terms.

The formations of above-stated bullish patterns evidence the upswings on both timeframes amid the major downtrend. For now, more rallies are possible only on a decisive break-out above 21-DMA and the stiff resistance of 125.995 levels, strong support is seen at 123.648 levels. The bullish momentum confirmed by leading oscillators but trend indicators decisive.

The major trend analysis: We kept reiterating from the last couple of months on a broader perspective, the streaks of bearish patterns as you could observe in the circular area of monthly plotting plummeted the prices below EMAs, whereas hammer at 124.601 (as stated above) attempts to bounce back, but unlikely to drag as the prevailing rallies are restrained below 21-DMAs and EMAs.

While bearish swings are backed by both momentum & trend indicators, hence, the current price still remained below EMAs.

Trade tips: Ahead of eurozone service PMIs which is likely to produce improved data, on hedging grounds, contemplating above technical factors, we advocate initiating longs in EURJPY futures contracts of Apr’19 delivery as further upside risks are foreseen momentarily and simultaneously, shorts in futures of May month delivery for the major downtrend. Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately (spot reference: 125.195 levels).

Currency strength index: FxWirePro's hourly EUR spot index is inching towards 61 levels (which is bullish), while hourly JPY spot index was at -142 (highly bearish) while articulating (at 06:41 GMT). These indices are also conducive for the above hedging set-up.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex