Fundamental updates:

We will not find out what will happen next to the ECB’s asset purchasing program until 8th December. ECB President Mario Draghi made that clear yesterday. He wants to wait for the results presented by the euro system working groups and also the new projections before a decision is taken.

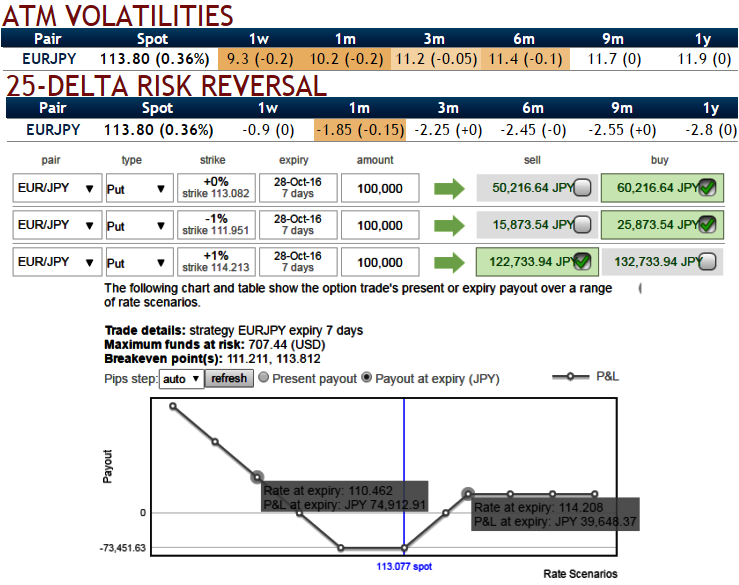

OTC Updates: The implied volatility of EURJPY ATM contracts are shrinking away across all timeframes, crawling down at 9.3%, 10.2% and 11.2% for 1w, 1m and 3m tenors respectively.

In option trading, the holders tend to perceive the put ratio back spread as a bear strategy, because it employs more numbers of long legs. However, it is in fact, a volatility strategy.

Usually, entering the position when implied volatility is on the higher side and waiting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options and one that makes a lot of sense. But when IVs are reducing it is the favorable sign for ITM writers in a slightly bullish or non-directional trend.

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1, to maximize returns.

As you can see delta risk reversals are indicative of participants in this pair are more concerned about further slumps especially in next 1month’s timeframe. Rising negative flashes indicate active hedging sentiments for these downside risks.

Acknowledging the gradual decrease in the implied volatility of EURJPY but with higher negative risk reversals in long run is justifiable when you have to anticipate forwards rates and observe the spot curve of this pair (see IVs, RR nutshell, Sensitivities, and compare with spot prices).

The major trend is declining trend, from last two years or so the pair has consistently evidenced considerable price slumps from the last couple of months, and we could still foresee more downside potential ahead.

Hedging Positioning:

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, the more number of longs comprising ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

“Short 1w (1%) ITM put option, go long in 1 lot of long in 2w ATM +0.49 delta put options and 1 lot of (1%) OTM -0.36 delta put of 1m expiry.”

Please be noted that the tenors and strikes chosen in the strategy is just for the demonstration purpose only.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis