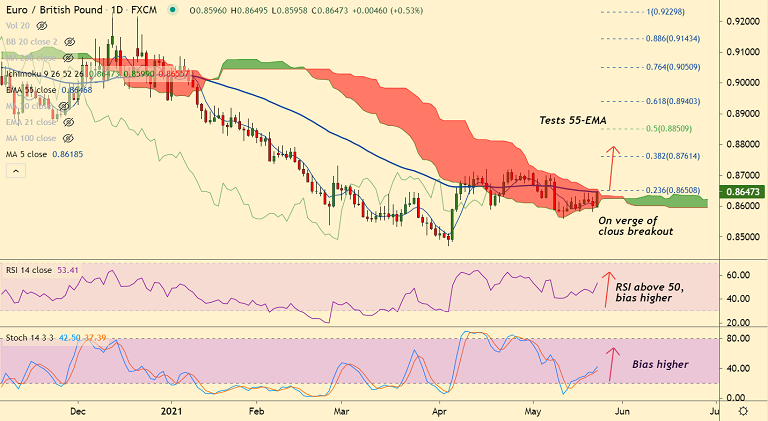

EUR/GBP chart - Trading View

EUR/GBP was trading 0.51% higher on the day at 0.8644 at around 10:40 GMT.

The pair has tested 55-EMA and 23.6% Fib retracement and is on verge of cloud breakout.

Technical indicators have turned bullish. Stochs and RSI are biased higher and RSI has edged above the 50 mark.

The pair has paused 4 straight weeks of downside and breakout above cloud will ensure further upside.

UK reopening optimism continue to underpin the pound, despite rising cases of the Indian covid variant.

Focus on Bailey's speech for further impetus. Upbeat UK Retail Sales last week also keeps the pound buoyed.

Breakout above cloud will see further gains. Next major resistance lies at 110-EMA at 0.8712 ahead of 38.2% Fib at 0.8761.