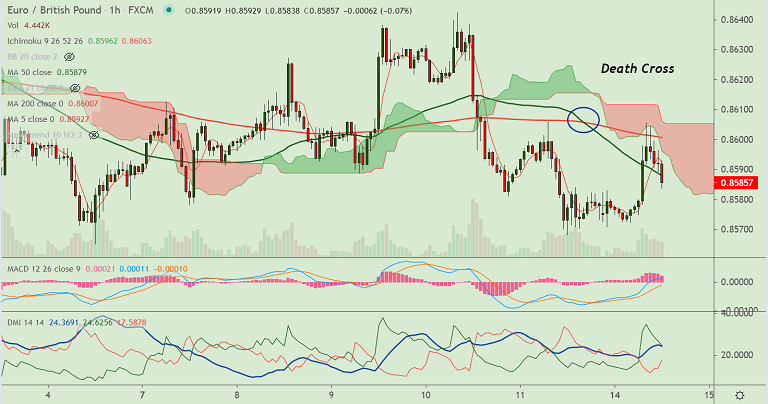

EUR/GBP chart - Trading View

EUR/GBP was trading 0.11% higher on the day at 0.8587 at around 12:35 GMT.

The pair's recovery attempt was capped at daily cloud, decisive break above required for upside continuation.

200H MA offers stiff resistance on the intraday charts, upside was rejected at 200H MA resistance at 0.86.

UK's potential delay its plans to end restrictions fully in light of the spread of the new Delta variant keeps downside pressure on the pound.

EU-UK collision over Norther Ireland protocol further contributed to the sterling's underperformance, keeping upside in the pair limited.

Technical bias is bearish. GMMA indicator shows major and minor trend is strongly bearish. Oscillators are biased lower.

Death Cross (Bearish 50-DMA crossover on 200-DMA) keeps downside pressure. The pair has been on a downside streak for the 7th straight week.

Further weakness on charts. Next major bear target lies at 0.85 (rising trendline) ahead of 88.6% Fib at 0.8415.