The pair is testing a crucial support at 0.7096, any breach below this level would mean that weaker trend is intact. So long term bears are under complete control but as of now this currency cross likely to take support at 0.7096 as many a times it has witnessed to show strength at the same levels and bounce back. We think valuations at this juncture become poor then it is going to be a tough call for euro amid Grexit threat.

On YoY basis, industrial output raised by 2.1%, the robust annual growth since April of 2014, and manufacturing was up 1.0%. Sterling has been higher against the broadly weaker euro, with EUR/GBP down 0.16% to 0.7074 from 0.7069 earlier.

The single currency came under pressure ahead of a euro zone summit later in the day which it was hoped would restart negotiations between Greece and its lenders.

The pound fell to session lows against the dollar on Tuesday after data showed that U.K. industrial output rose unexpectedly in May but manufacturing production fell and as heightened risk aversion bolstered dollar demand. GBP/USD fell to lows of 1.5509, the weakest since June 15 from around 1.5530 ahead of the report.

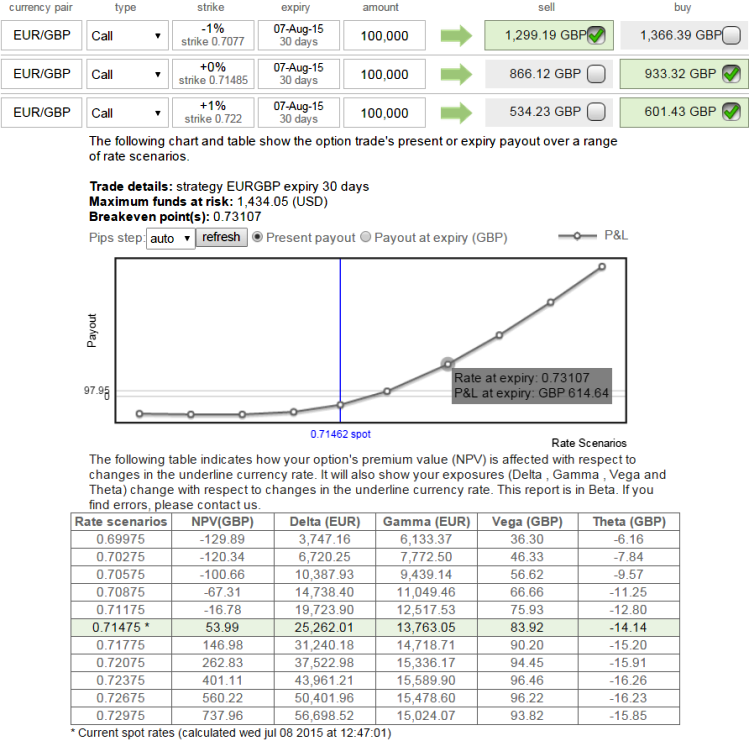

Currency Option basket: Call ladder (EUR/GBP)

We think unless arbitration opportunity that offers chances in cross currency gains, those who have their FX exposures held in euro, they've to find their ways out within euro zone only so as to reduce the further potential downside risks.

Hence, we recommend selling 1M (-1%) in-the-money call, simultaneously buy 1M an at-the-money 0.51 delta call and buy another 1M (1%) out-of-the-money 0.38 delta call.

The combined position should have delta at 0.25 and negative theta close 0.14 or so.

This strategy is likely to fetch an unlimited returns and limited risk when the options trader thinks that the underlying currency will experience significant volatility in the near term.

Maximum returns for the short call ladder strategy is limited if the underlying stock price goes down. In this scenario, maximum profit is limited to the initial credit received since all the long and short calls will expire worthless.

However, if the underlying exchange price rallies explosively, potential profit is unlimited due to the extra long call.

FxWirePro: EUR/GBP on downtrend, prefer call ladder construction

Wednesday, July 8, 2015 7:30 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand