German Ifo expectations on business climate will be closely viewed today as the German manufacturing PMI surprised on the upside yesterday, whereas the ZEW expectations suggest a decline in Ifo expectations.

We stick to our forecast that the Ifo expectations will decline as the actual situation in Germany has improved, implying the outlook will not continue to look even better. However, it is not likely to have any market implications as long as the Greek situation remains unsolved.

Hence, EUR/GBP will likely to drag down further but German IFO may cushion the slumps, using back spreads keeps safe play instead of naked puts.

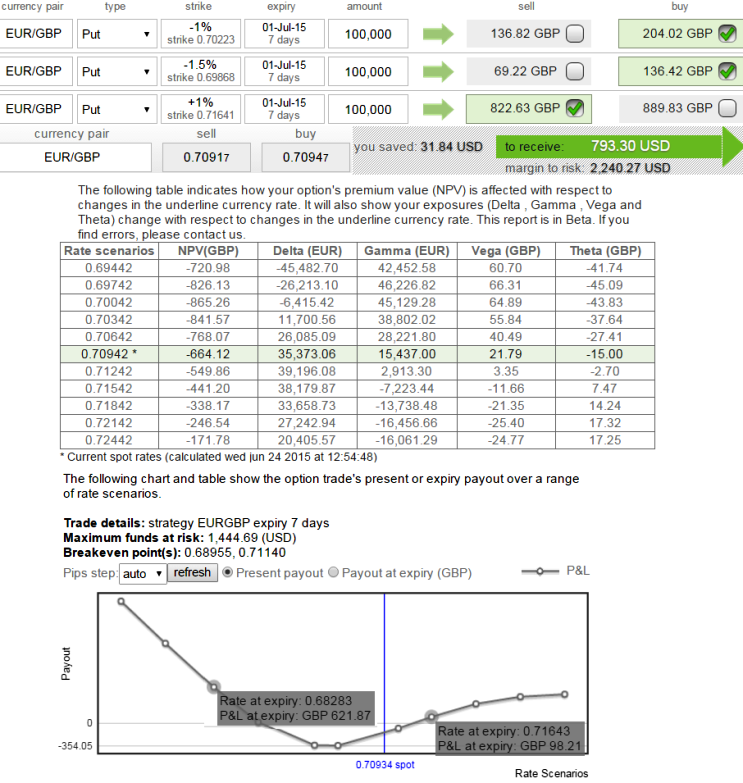

Although the current trend has been bearish, we advocate buying back ratio spreads using 2 Out-Of-The-Money puts and 1 In-The-Money put options of EUR/GBP.

In order to execute this strategy as shown in the diagrammatic representation, add 2 lots of longs of (-1%) OTM and (-1.5%) deep OTM put and simultaneously short (1%) ITM put options with the similar maturity.

The delta on combined position should be at 0.35 and negative theta of -15 signifies time decay benefits.

FxWirePro: EUR/GBP likely to drag down further but German IFO to cushion, prefer back spreads over naked puts

Wednesday, June 24, 2015 7:34 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary