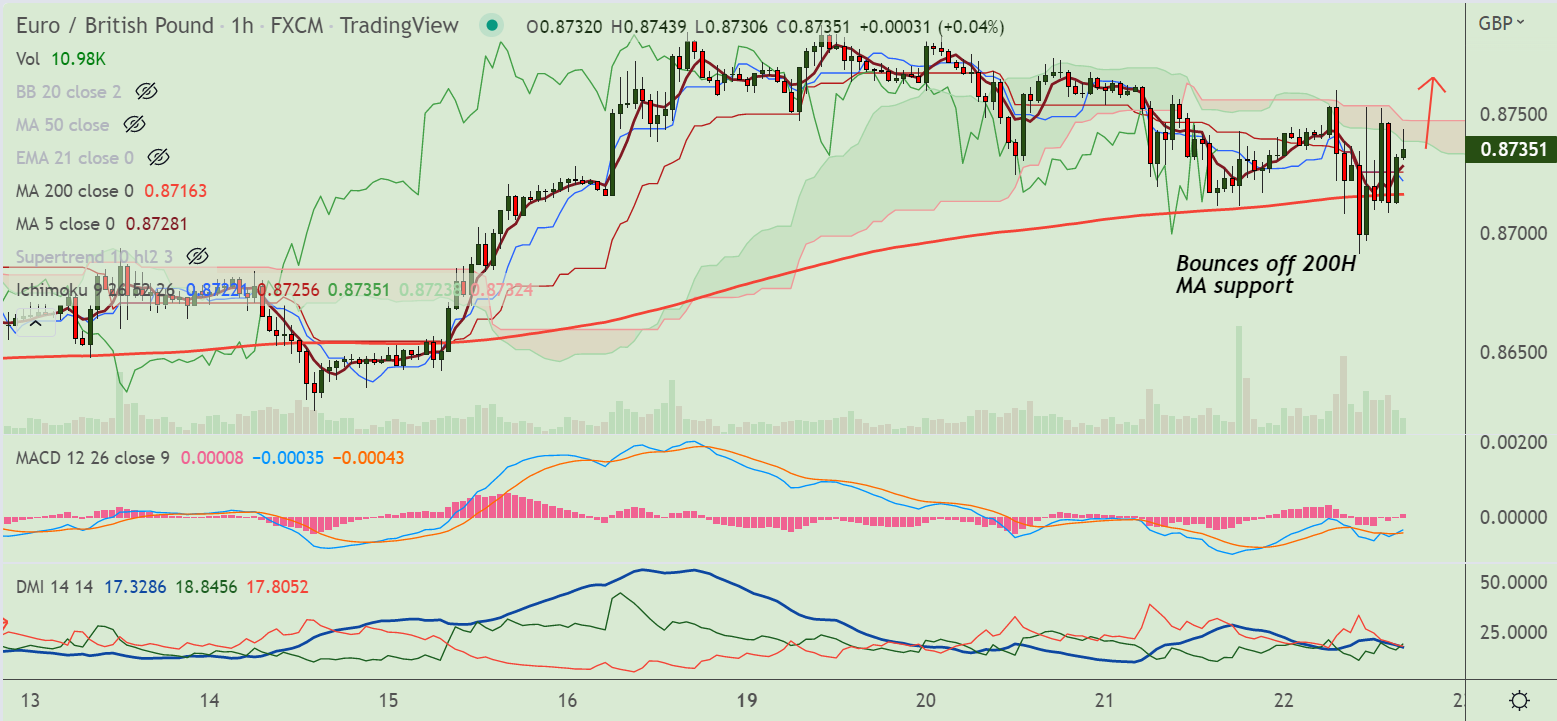

Chart - Courtesy Trading View

EUR/GBP was trading 0.15% higher on the day at 0.8739 at around 16:20 GMT, edges higher from session lows at 0.8691.

The British pound pops following monetary policy decision of the Bank of England, rising rates by 50 bps to the 2.25% mark.

The central bank also said that it would continue to “respond forcefully, as necessary” to elevated prices.

Further, the MPC voted to reduce the BoE’s GBP 838 Billion by 80 billion pounds over the coming year.

The pound edged higher after the rate hike, but quickly gave up all gains after the BoE’s projected a 15-month recession, likely to begin by the year’s end.

EUR/GBP has bounced off 200H MA support, price action hovers around 5-DMA, close above will see more upside.

Momentum to remain with the bulls as long as price action holds above 200-week MA.