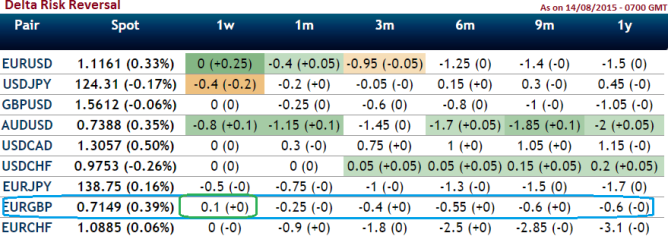

As you can make out from the nutshell, bulls gaining buying interest as 1W ATM contracts showing positive flashes but this is yet to be confirmed in long run even on technical charts. The same ATM contracts for next 6 months to 1 year expiries suggest prevailing long lasting downtrend still remains intact.

While EOD technical charts have shown some recovery from last week's lows at 0.6949 levels. Intraday sentiments are also slightly bearish bias and leading indicators fortify these downswings with downward convergence. Things seem like taking track back onto its usual business on euro side, the euro continue to freezing its long lasting loses against sterling and held sturdy in early Asian trades today.

The convergence on RSI is seen with rising prices on daily charts as it is trending near 57.6715 levels with no proper supportive signal from stochastic curve as an attempt of %D crossover above 80 levels which can neither be considered as oversold nor overbought pressure as of now. These signals can be attributed as positive movers for those who expect price slumps; however closing figures should be crucial for long-term decision making.

Hence, for another 3-4 days of trading sessions may show upswing rallies then upon proper confirmation by subsidiary indicators trend reversal signals are identified, so far it is still downward bias in our opinion.

Trade Tips:

On a swing trading perspective, it is smart to sell on rallies, we advocate buying binary delta puts for targets of 20-25 pips. Intraday charts sell signal caused by RSI curve as strength in rallies do not hold for long time. Instead the RSI curve is moving in convergence with dipping prices.

FxWirePro: EUR/GBP delta risk reversal indicates short term upswings most likely but major downtrend puzzling

Friday, August 14, 2015 8:46 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate