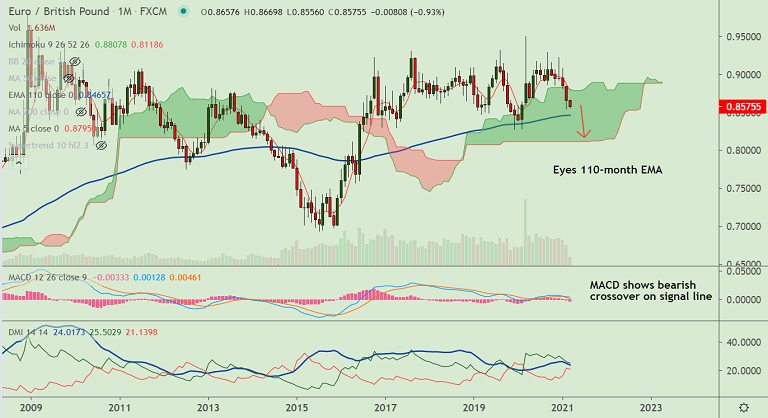

EUR/GBP chart - Trading View

Technical Analysis: Bias Bearish

- EUR/GBP extends marginal gains after eurozone Q4 GDP data

- Edges higher from 9-day lows at 0.8556, but recovery lacks traction

- Long upper wicks on the hourly candles show selling pressure at highs

- Technical indicators are strongly bearish. Price action below major moving averages

- GMMA indicator shows major and minor trend are strongly bearish

Support levels - 0.8471 (Mar 2019 low), 0.8465 (110-month EMA), 0.8415 (88.6% Fib),

Resistance levels - 0.8597 (5-DMA), 0.8665 (21-EMA), 0.8685 (55-month EMA)

Summary: EUR/GBP attempts tepid recovery from 9-day lows at 0.8556. Outlook remains strongly bearish. 5-DMA caps upside at 0.8567. Eurozone GDP prints better than initial estimates. Focus now on ECB interest rate decision. Analysts expect EUR appreciation could trigger ECB verbal intervention, which may weigh on the Euro, dragging the pair lower. Scope for test of 110-month EMA at 0.8465.