The EURCHF’s projection is for a return to 1.20 by 2Q’18 and the current price behavior is well on track of this target. Bulls spike above DMAs in rising channel, sensing more buying sentiments upon bullish DMAs crossover with support from momentum indicators. In this process, the pair has managed to break-out the stiff resistance levels of 1.1715 -1.1740.

The major trend reversal prolongs upside traction after break-out of range resistance (refer monthly plotting). The buying sentiments on this timeframe have taken the current price to hit multi-months (23-months) highs of 1.1771 levels, both leading & lagging indicators to substantiate this bullish interest.

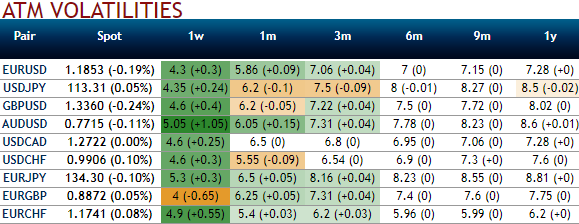

OTC outlook and Options strategy: Before we proceed further with the options strategy, let’s glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of 1w-1m expiries have still been the least among G10 currency segment. Usually, the lower volatile conditions are conducive for the option writers under the circumstances of the range bounded trend.

Amid the prevailing uptrend that we’ve been witnessing in EURCHF, positively skewed IVs of 1m tenor still signify the hedgers’ interests for bearish risks (bids for OTM puts strikes upto 1.1650). Please also be noted that the bearish neutral risk reversal of EURCHF does not indicate dramatic shoot up.

Thus, in order to sync with the above fundamental factors, the technical trend of the underlying price and the OTC indications, we advocate below options strategy.

From the above technical chart, it is clearly understood that the upside risks are on cards. As a result, ITM calls have been in high demand.

We formulate suitable hedging framework contemplating all the above aspects. Place call ratio spread with 1:2 ratios.

How to execute: At spot reference: 1.1768, buy ITM (1.1480) +0.66 delta call with longer expiry (let’s say, 3m tenor). Sell two lots of OTM strike calls (1.2065) of comparatively narrowed tenors (say 1m). Thereby, we’ve formulated the strategy so as to sync ongoing technical trend with the delta risk reversal.

The delta value becomes more and more insensitive as the EURCHF falls lower and lower and hence on the lower side, the delta value is zero.

On the higher side, it increases in magnitude but remains negative indicating the negative effect on the options trader position with the pair rallying.

Why call ratio spread: As the pair has made sharp rallies with minor hiccups, we see a neutral to bearish environment in near run when you are projecting decreasing volatility (see from next 1 month to 3 months it’s been gradually reducing)

Risk/Reward Profile: The risk is unlimited. The reward is the difference in the strike prices plus the net credit, multiplied by the number of long contracts.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -3 levels (which is neutral). While hourly CHF spot index was at shy above 3 (neutral) while articulating (at 12:33 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes