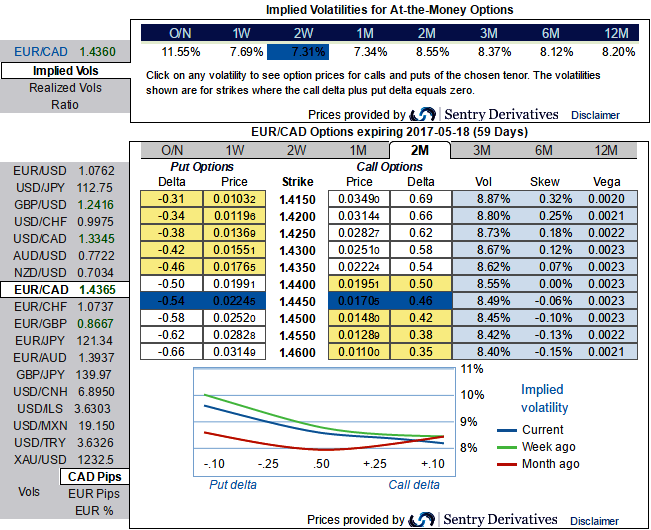

Please be noted that the implied volatilities of EURCHF ATM contracts from the nutshell evidencing IVs the contract of this underlying pair of all expiries have been the least among G10 currency segment. These lower volatile conditions are conducive for the option writers.

While the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps but seems to be one of the pairs to be hedged for downside risks in the long run as it indicates puts have been relatively costlier.

EURCHF’s range bound pattern is still persisting but some bearish candles are indicating slight weakness on both weekly and monthly charts on technical base, (Ranging between upper strikes 1.1199 and lower strikes at around 1.0621 levels.

For now, we could still foresee range bounded trend to persist in near future but little weakness on weekly charts is puzzling this pair to drag southward targets but very much within above-stated range.

As a result, we recommend below option strategies using right options, thereby, one can benefit from certain returns.

Naked Strangle Shorting:

Short 3m OTM put (2% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (2% strike referring upper cap) (we reiterate, on this leg short term for maturity is desired comparatively).

Overview: Slightly bearish in short term but sideways in the medium term.

Time frame: 3 months

But on the contrary, gradual euro strength should nudge EURCHF higher but significantly. As a result, chances of calls being priced exorbitantly could be expected on account of the litany of European political risks.

Alternatively, one can also prefer OTM call option as they are overpriced when compared to their NPVs with IVs of the corresponding tenors (2w OTM calls have been overpriced more than 300% than NPV, while IVs of this tenor is still jerking).

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Hence, writing such calls seems smart choice in tepid IVs on speculative or trading grounds.

Considering above OTC market reasoning, amid prevailing uptrend we think downside risks can also not to be disregarded in the long term, as result we reckon deploying shorts in such exorbitant call options.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios