• EUR/AUD dipped on Tuesday as Australian dollar strengthened against the euro following the release of key domestic economic data.

• Australian consumer sentiment bounced in August as rate fears subsided . The Westpac-Melbourne Institute index of consumer sentiment rose 2.8% in August from July.

• The pair hit daily low at 1.6533 and was last trading at 1.6566 at 16:15 GMT .

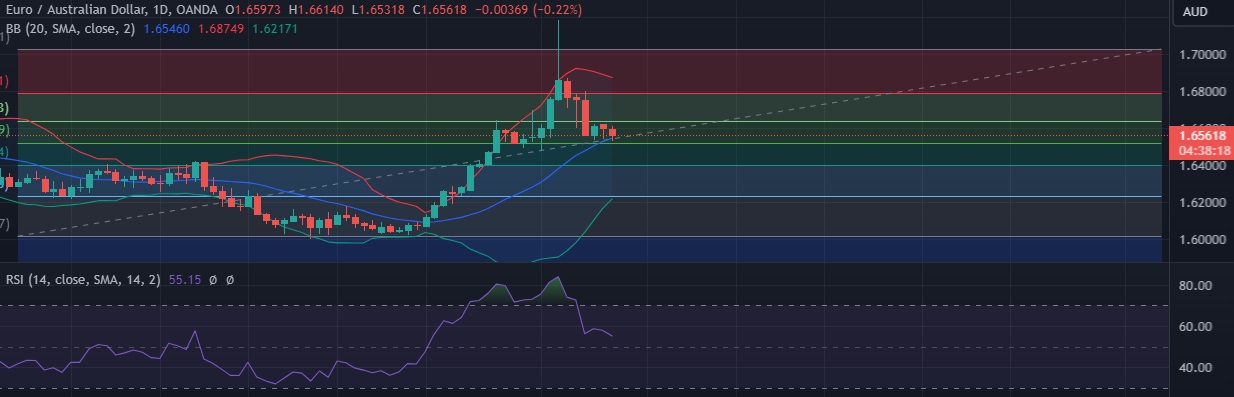

• Immediate resistance is located at 1.6641(38.2% fib), any close above will push the pair towards 1.6789 (23.6% fib).

• Immediate support is seen at 1.6527 (50% fib) and break below could take the pair towards 1.6369 (61.8% fib).

Recommendation: Good to sell around 1.6570, with stop loss of 1.6100 and target price of 1.6500