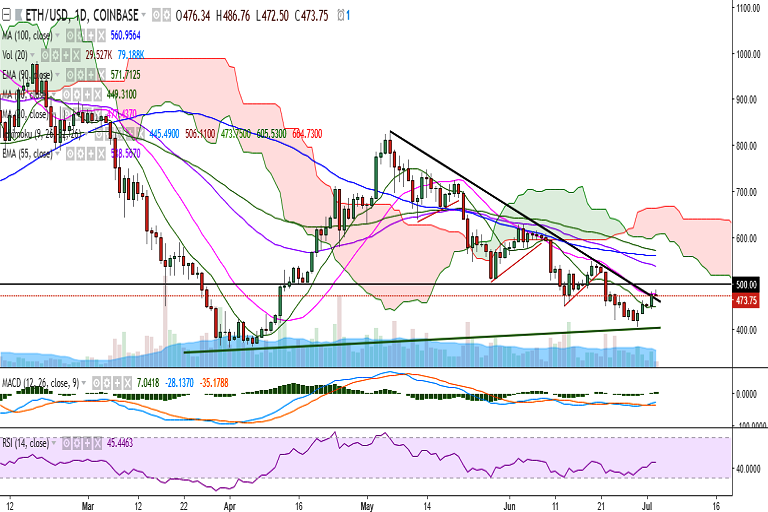

ETH/USD is trading in a narrow range on Tuesday as it hovers around 20-DMA at 476 levels at the time of writing (Coinbase).

The recent uptick in the prices of cryptocurrencies could have been driven by the positive news coming from China. While the country banned all ICO and fiat-to-crypto trading activities last year, the China Banking Regulatory Commission (CBRC) has called upon the country’s legislators to consider issuing licenses for crypto-related businesses.

On the upside, a close above 477 (20-DMA) would target 500/516 (4h 200-SMA). Further strength would see the pair testing 552 (50-DMA)/571 (90-EMA).

On the downside, a break below 460 (1h 50-SMA) would drag the pair to 445 (1h 200-SMA)/406 (trend line joining 360 and 404.22)/368 (113% extension of 828.97 and 421.10).

Momentum studies: On the daily chart, bullish MACD crossover and stochs with bullish momentum suggest scope for further upside, while RSI is below 50.

Watch out for a decisive break above 500 levels for minor bullishness in the pair.

FxWirePro: ETH/USD hovers around 20-DMA, decisive break above 500 to see further upside

Tuesday, July 3, 2018 10:09 AM UTC

Editor's Picks

- Market Data

Most Popular