The US President Donald Trump continues to provoke. On last Friday he fuelled concerns via Twitter that the trade war could turn into a currency war. The US dollar depreciated significantly after Trump explicitly accused the EU and China of manipulating their currencies to gain an unfair trade advantage.

Collateral damage to EM from a US-China trade war could be significant, particularly on EM Asia. Trade tension concerns have not yet moved EM fixed income assets much compared to EM vulnerability-related weakness.

Apparently, the unfazed by the accusations of FX manipulation from Washington the Chinese central bank PBoC emphasizes that its monetary policy guidance would focus on counterbalancing the downside risk for growth. Additionally, to a supplementary liquidity injection, the new rules for the asset management sector were less restrictive than expected.

Following an epidemic of growth downgrades, the recent data are now tracking more in line with JPM’s forecast. The second half of 2018 deceleration in DM would broaden the EM-DM growth differential again unless USD strength continues. The clear risk to the downside is an escalation in anti-trade measures.

EM central banks have been under pressure owing to currency softness, and the pressure has broadened out. EM central banks have erred on the hawkish side over the past month, with Mexico, Indonesia, the Philippines, and the Czech Republic all delivering surprise rate hikes relative to our forecast. Only one central bank (Romania) surprised us on the dovish side.

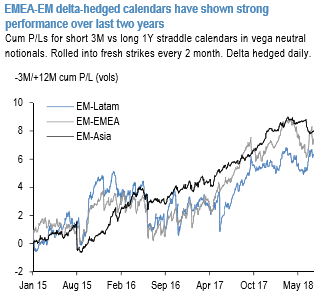

Vega is the sensitivity of an option’s value to a change in volatility. It is typically expressed as the change in premium value per 1% change in implied volatility. Traditionally, short gamma, vega neutral structures (refer above chart) of the type short front / long back vol have performed well within EM where spot tends to be under the watchful eye of central bankers while most of the market pricing gets filtered into back tenors.

Within EM, EM Asia has been the most consistent outperformer but EM-EMEA also have shown strong average with an overall Sharpe ratio of 0.7 for short 3M/long 12M delta hedged straddles over the last 3-years.

Conditioning the entry into the trades by 1Y-3M spread (in terms of 1-y z score) improves the overall P/L and results in 81%, 70% and 68% probability of making profits in EM-Asia, EMEA EM and Latam, respectively. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 23 (which is mildly bullish), while USD is flashing at -125 (bearish) while articulating at 06:53 GMT.

For more details on the index, please refer below weblink:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays