We see room for cutting the deposit rate to -0.75%, but there is no technical limit for an instance.

With Draghi signalling that we are close to the limits on the deposit rate, however, further cuts are not likely in the short term.

Importantly, we see little benefit from squeezing banks in an environment of regulatory uncertainty and structural rigidities.

An agreement has been reached on “A new settlement for the United Kingdom within the European Union”. It is a much-diluted set of “reforms” compared with David Cameron’s original aims when he first promised a referendum on Brexit.

Euro gained against dollar about 8.24% in last 5 and half months despite ECB’s monetary policy pressures, but central bank’s pressures have hampered euro’s growth pace but confronting to address geopolitical issues.

Cheap EURO 2y5y ATMF payers vs 1y1y5y mid curve payers – Hedge against higher rates:

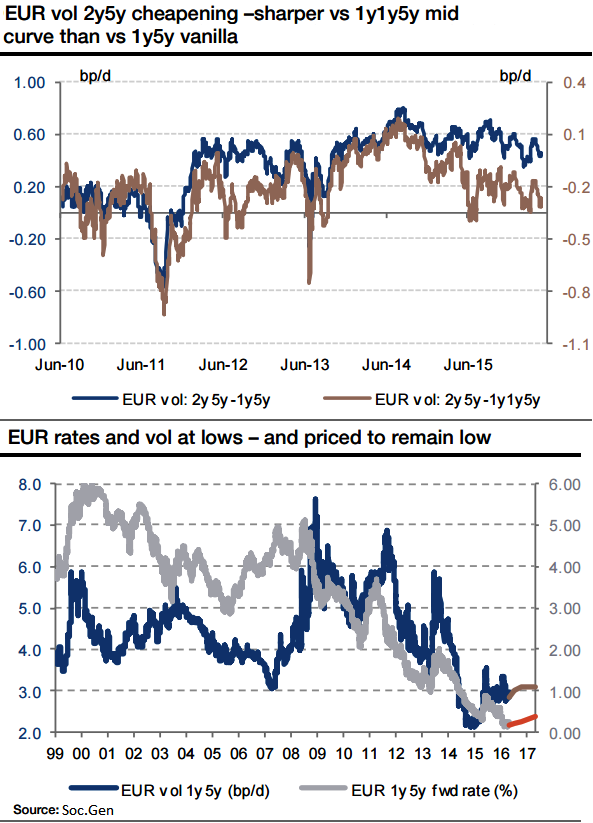

EUR 2y5y swaptions volatility is cheap in the EUR vol grid - especially compared to 1y5y, with the vol calendar spread having traded below its current level only 7% of time since the ECB cut rates below zero in June 2014.

From a longer-term perspective, EUR 2y5y cheapening has been sharper vs 1y1y5y mid-curve vol than vs 1y5y vanilla (see chart).

Buying EUR 2y5y ATMF payers vs selling 1y1y5y ATMF mid-curve payers (same strike, same notional) costs 8.5bp running (indicative), which is more than two times less than a simple calendar spread buying 2y5y ATMF payers and selling same strike 1y5y payers.

Technicalities on Long forwards:

If in a year's time rates remain lower or equal to their current 1y forwards, the 1y1y5y payer expires OTM and the strategy becomes, a pure long 1y5y payer, at today's 2y5y ATMF strike (0.37%).

This is a fundamental scenario we target for EUR rates, with limited scope for a significant belly-driven sell-off in the coming months.

Longer term, if rates eventually increase, volatility will follow higher. At expiry of the 1y1y5y option, mark-to-market PL is 2bp running if rates and vol remain at current levels and c. 10bp running if forwards realise (i.e. the 1y5y forward increases from today's 0.16% to 0.37%).

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022