We are foreseeing for excess reserves at the ECB to rise above EUR 1,000 bn. Although the European central bank is pumping in money by buying securities worth EUR 80 bn every month and hence increasing the excess reserves by this amount, daily purchase volumes differ, of course.

But it is certain that the threshold will be exceeded on one of the coming days. The ECB would certainly not end the monthly purchases in the near future. This means that excess reserves will rise by roughly another trillion every year but the second trillion will be more difficult.

The effects on the banking system and potential adjustments to the ECB programme, there is one key effect on all market participants, which stems from the fact that the market needs to digest two problems.

First, the excess reserves of the banking system as a whole will rise by EUR 80 bn per month. If anybody thinks the banks could prevent this development by lending more, they would need to explain to me why lending has not risen yet. In addition, the ECB reserves are obviously rising by roughly this amount every month – just look at the figures.

Second, it is up to the individual banks to implement the increase in the excess reserves of the banking system as a whole.

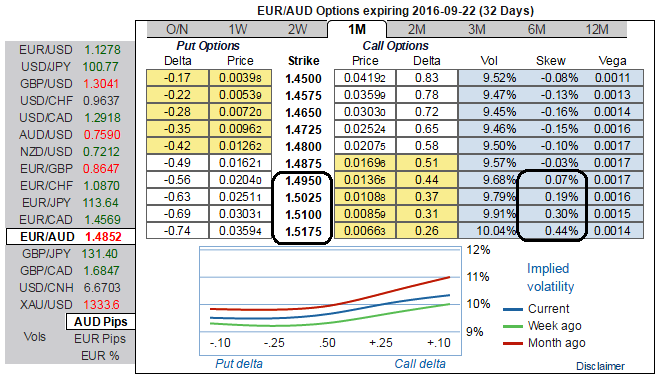

OTC outlook:As a resultant effect of fundamental developments as discussed above, the sentiments in OTC market for EURAUD have been notably changing, you can probably make out 1w IVs skews creeping up in positive numbers and IVs rise just shy above 10% for this expiry. This indication means there is more bets on EUR calls and AUD puts as the OTC market sentiments are more concerned about the underlying spot may shift towards OTM calls strikes on expiration.

The volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

The current spot FX is trading at 1.4861, since major trend appears to weaker to extend slumps up to 1.47 levels in medium terms, aggressive bears can initiate hedging strategy either by using credit put spreads or by shorting mid-month futures as the currently mild bullish environment is hovering around this pair, any upswings are to be optimally utilized in the hedging strategy to reduce the cost.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target