A glimpse through fundamentals: ECB monetary policy will be on autopilot in the near future and thus diminish in importance as a driver for the euro in the coming weeks, leaving the currency open to vagaries of other factors such as US-dynamics, which are more dollar bullish at the moment (a substantially better-than expected US GDP outcome this week reinforces strong growth momentum for the dollar).

The Federal Reserve last night left interest rates unchanged at 1-1.25%, as expected. There was no press conference or update of economic forecasts. The press statement was largely unchanged: it sounded a little more upbeat about recent economic developments, while still acknowledging some concerns about low inflation. A December US rate rise is still likely, even though it was not explicitly signalled. Separately, President Trump is due to announce the next Fed Chair at 19:00GMT. His pick is expected to be Jerome Powell, who is a current Fed Governor, and would represent continuity in monetary policy. Powell is scheduled to speak at an event today.

Thus a monetary policy catalyst for euro strengthening will be lacking in the near-term. Instead, US-specific factors will dominate in the near-term.

Moreover, the Euro area political risks which will likely become more negative into Q1 given Italian elections. The longer-term view is still euro bullish since focus will eventually shift to ECB rate hikes (Sep’18) EURUSD target is at 1.25.

But the near-term outlook is more fragile given the factors outlined above, in combination with crowded EUR longs and EURUSD overshooting rate differentials on most frameworks (chart 3).

Options strategy: Buy EURUSD 2m put spread, strikes 1.1450/1.1350 Indicative offer: 0.18% (spot ref 1.1649000).

Max leverage: 5.6x, the short put finances half of the cost.

The maximum payout at expiry (the strikes’ difference captures one figure) at and below 1.1350 is more than five times the premium.

Rationale: Euro at risk of a deeper correction, ECB is in autopilot mode, having mentioned that, following last week’s ECB dovish communication, the softer euro triggered a massive selloff in the EURUSD vol market.

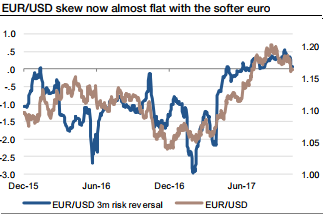

Both volatilities and risk reversals (RR) are under significant selling pressure, with the front-end of the implied vol curve returning to its summer lows (the sub 3m segment is trading below 7), and short-dated RR trading at nearly flat levels.

However, the short-dated skew did not turn negative, leaving OTM short-dated euro puts still a cheap hedge if all the pieces are in place for a deeper correction.

Risk profiling: Limited to the premium, as the trade is intended to be a hedge, investors buying this standard put spread structure cannot lose more than the premium initially paid.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist